About this Resource

Comprehensive Yet Flexible Organization. The text provides a firm foundation for learning by first describing the overall investment environment, including the various investment markets, information, and transactions. Next, it presents conceptual tools needed by investors—the concepts of return and risk and the basic approaches to portfolio management. It then examines the most popular types of investments - common stocks, bonds, and mutual funds. Following this series of chapters on investments is a chapter on how to construct and administer one’s own portfolio. The final section of the text focuses on derivative securities - options and futures - which require more expertise. Although the first two parts of the text are best covered at the start of the course, instructors can cover particular investment types in just about any sequence. The comprehensive yet flexible nature of the text enables instructors to customize it to their own course structure and teaching objectives.

Timely Canadian Topics. Current events, changing regulations, and other factors constantly reshape financial markets and investments in the Canadian market. Virtually all topics in this text take into account changes in the Canadian investment environment.

Learning Objectives: Each chapter begins with six Learning Objectives, labelled with numbered icons. These goals anchor the most important concepts and techniques to be learned. The Learning Objective icons are then tied to key elements of the chapter. This tightly knit structure provides a clear road map for students— they know what they need to learn, where they can find it, and whether they’ve mastered it by the end of the chapter.

An Opening Story sets the stage for the content that follows by focusing on an investment situation involving a real company or real event, which is in turn linked to the chapter topics. The opening vignette makes clear the relevance of these topics to the world of investments.

Short Video Clips offering An Advisor’s Perspective show professional investment advisors discussing the investment topics covered in each chapter.

CFA Exam Questions from the 2010 Level One Curriculum and the CFA Candidate Study Notes, Level 1, Volume 4, are included at the end of each part of the text. Because of the nature of the material in some of the early chapters, the CFA questions for Parts One and Two are combined and appear at the end of Part Two. These questions give students an opportunity to test their investment knowledge against that required for the CFA Level I exam.

Investor Facts. Brief items that cite an interesting statistic or relate an unusual investment experience. These facts add a bit of seasoning to the concepts under review and capture a real-world flavour. The Investor Facts include material focused on topics such as art as an investment and the need to exercise caution when reading analysts’ recommendations and media coverage of stocks.

Calculator Keystrokes. At appropriate spots in the text, students will find Calculator Keystrokes sections on the use of financial calculators, with calculator graphics that show the inputs and functions to be used. The financial calculator callout in the text indicates that the reader can use the financial calculator tool in MyLab Finance to find the solution for an example by inputting the keystrokes shown in the calculator screenshot.

Discussion Questions, keyed to the Learning Objectives, guide students in integrating, investigating, and analyzing the key concepts presented in the chapter. Many questions require that students apply the tools and techniques of the chapter to investment information they have obtained and then make a recommendation regarding a specific investment strategy or vehicle. These project-type questions are far broader than the Concepts in Review questions within the chapter.

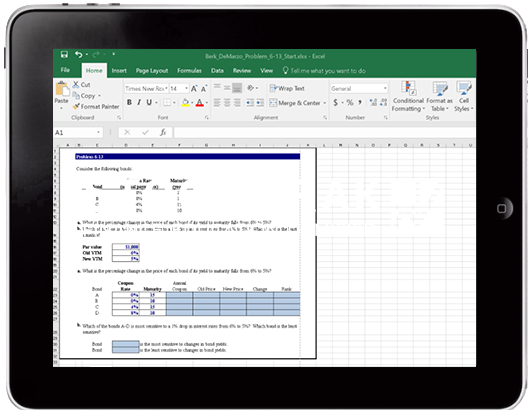

Auto-graded Excel Projects using proven, field-tested technology, let you seamlessly integrate Microsoft Excel content into your course without having to grade spreadsheets manually. Students can practice important statistical skills in Excel, which helps them master key concepts and gain proficiency with the program. They simply download a spreadsheet, work live on a statistics problem in Excel, and then upload that file back into MyLab Finance. Within minutes, they receive a report that provides personalized, detailed feedback to pinpoint where they went wrong in the problem.