13. Statement of Cash Flows

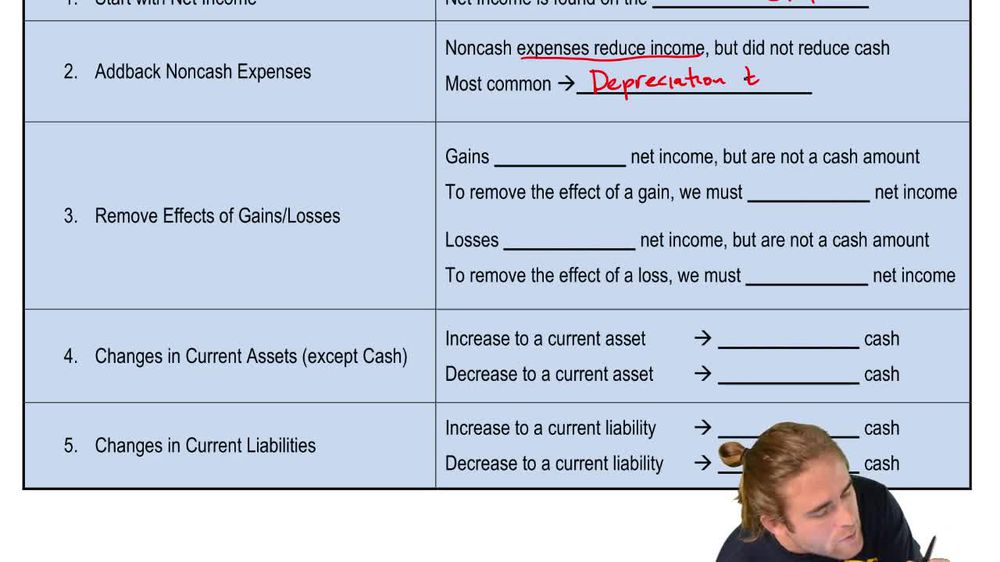

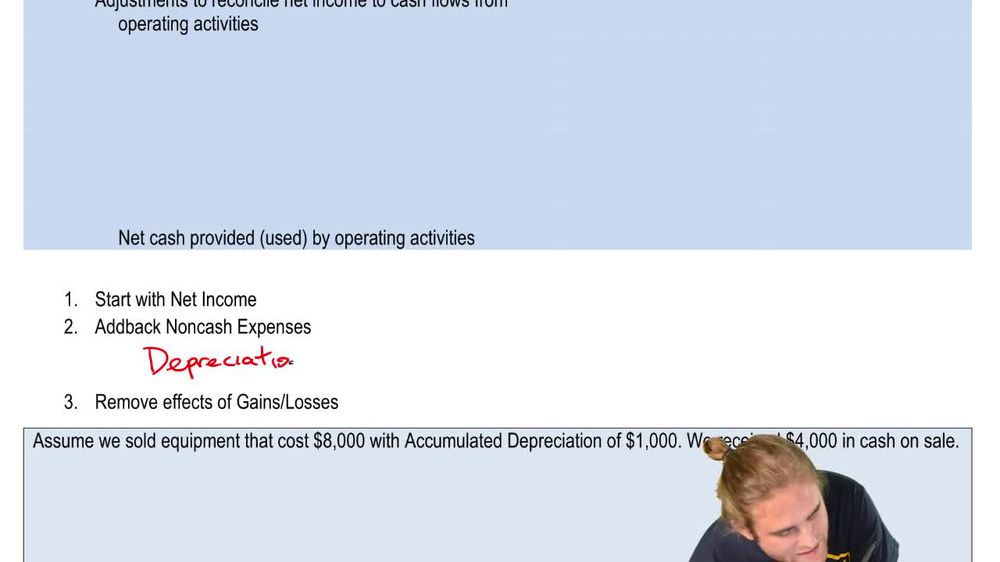

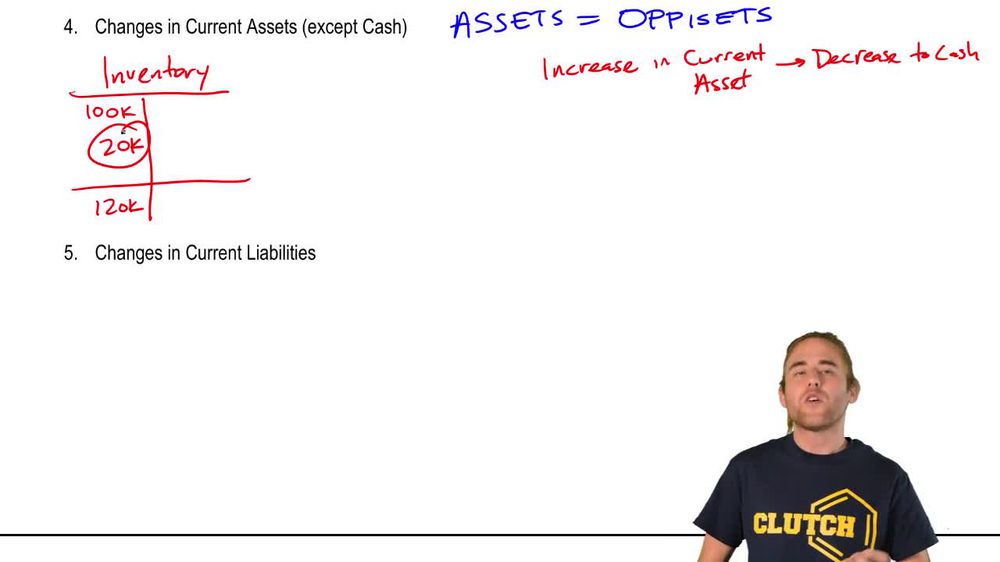

Operating Activities: Indirect Method

13. Statement of Cash Flows

Operating Activities: Indirect Method

Practice this topic

- Multiple Choice

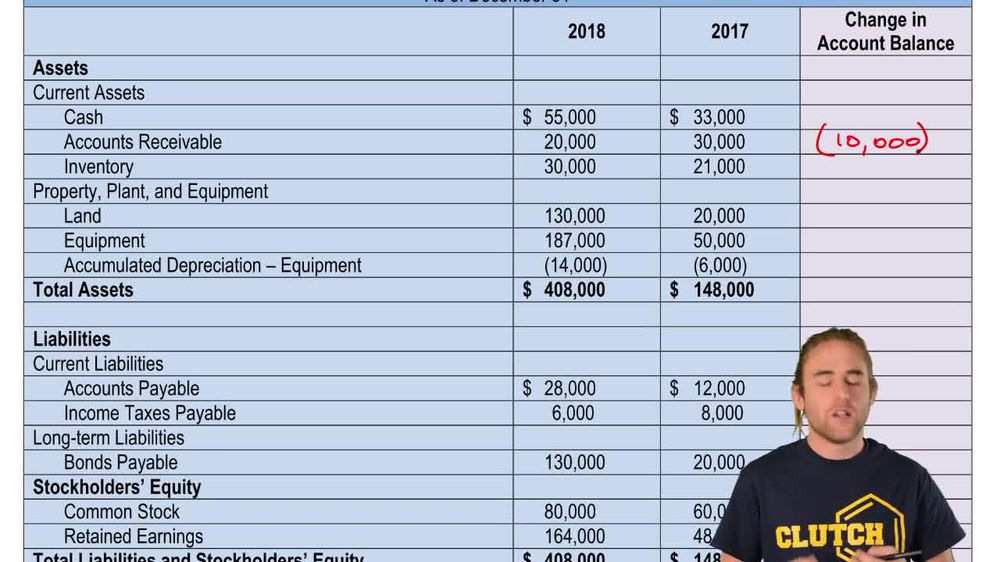

A company reported net income of \$250,000. Depreciation and amortization totaled \$120,000. In total, Current assets excluding cash increased by \$25,000 and current liabilities increased by 16,000. The company also had a gain on the sale of equipment of \$4,000. Using the indirect method, what are cash flows from operating activities?

384views10rank - Multiple Choice

A company had net income of \$240,000. Depreciation expense was \$36,000. During the year, the accounts receivable and Inventory increased \$12,000 and \$25,000, respectively. Accrued expenses and prepaid expenses decreased by \$3,000 and \$14,000, respectively. There was also a gain on the sale of equipment of \$4,000. How much cash was provided by operating activities?

381views12rank1comments - Multiple ChoiceWhich of the following transactions is classified as an operating activity under the indirect method of the statement of cash flows?85views

- Multiple ChoiceWhich one of the following is an example of cash flows from operating activities under the indirect method?129views