14. Financial Statement Analysis

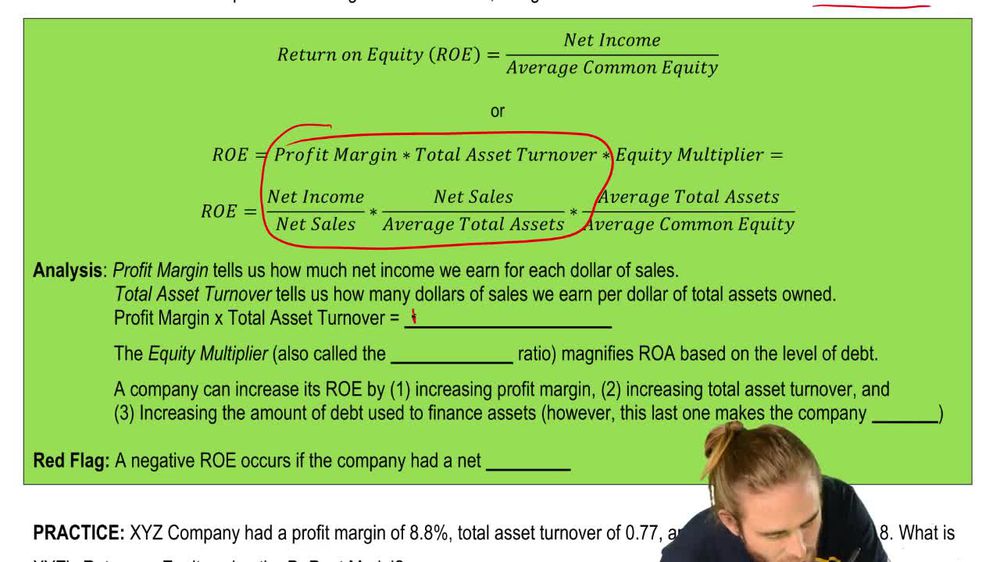

Ratios: DuPont Model for Return on Equity (ROE)

Practice this topic

- Multiple Choice

XYZ Company had a profit margin of 8.8%, total asset turnover of 0.77, and an equity multiplier of 1.8. What is XYZ's Return on Equity using the DuPont Model?

262views - Multiple Choice

A company had a profit margin of 6.1%. The company's net sales were \$3,600,000 and Cost of Goods Sold was \$600,000. If total assets were \$3,450,000 at the beginning of the year and \$4,210,000 at the end of the year, and total equity was \$2,500,000 at the beginning of the year and \$3,100,000 at the end of the year, what is the company's return on equity using the DuPont model?

244views1rank - Multiple Choice

A company with net sales of \$820,000 and net income of \$210,000, average total assets of \$1,400,000 and average common equity of \$940,000 is using the DuPont Model for financial analysis. What is the company's ROE?

144views1rank - Multiple ChoiceWhich one of the following does NOT affect Return on Equity (ROE) according to the DuPont identity?90views