6. Internal Controls and Reporting Cash

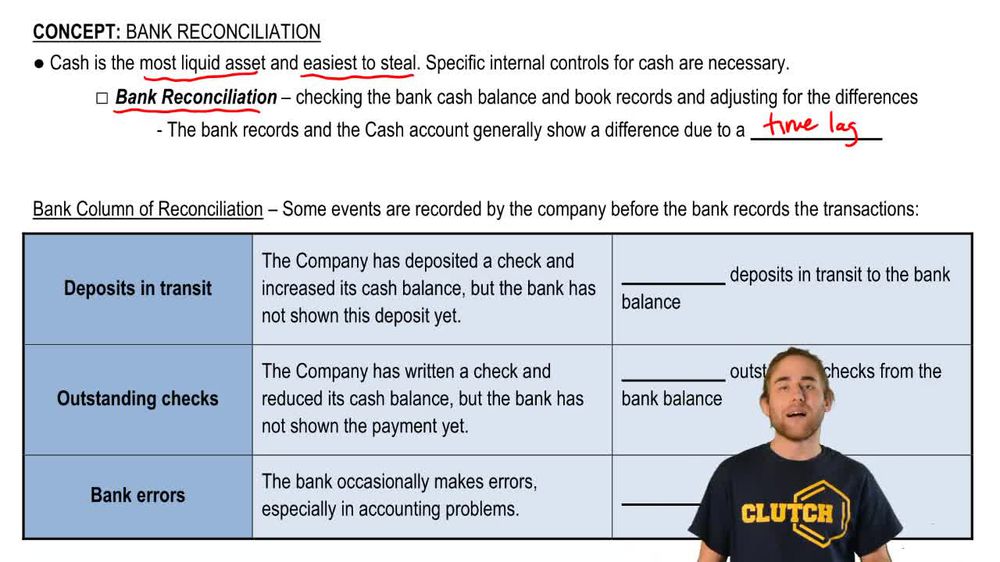

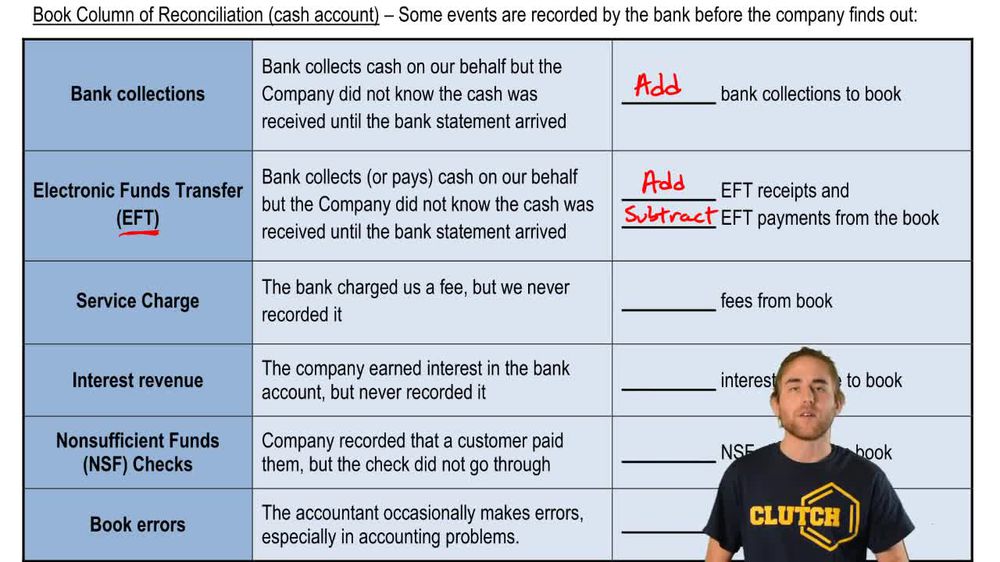

Bank Reconciliation

6. Internal Controls and Reporting Cash

Bank Reconciliation

Practice this topic

- Open Question

A company has a current balance in its Cash account of \$3,400. The bank statement arrived showing a bank balance of \$5,900. Prepare the cash reconciliation noting the following events:

• Deposits in transit total \$600

• EFT receipt of dividend revenue of \$900

• Bank error:the bank deducted \$100 for a check written by another company.

• Service charge \$20

• NSF check from a customer \$50

• Book error:Company Check no. 333 was recorded for \$510. The actual amount paid on account was \$150.

• Outstanding checks total \$2,010

259views30rank - Multiple ChoiceIn a bank reconciliation, which of the following items would be subtracted from the company's book balance to arrive at the adjusted book balance?93views

- Multiple ChoiceWhich of the following is most likely to cause a bank statement not to agree with the cash balance in the accounting records?100views

- Multiple ChoiceWhat is the last step in reconciling a checking account?94views

- Multiple ChoiceWhen you reconcile your checking account, what are you primarily doing?132views