7. Receivables and Investments

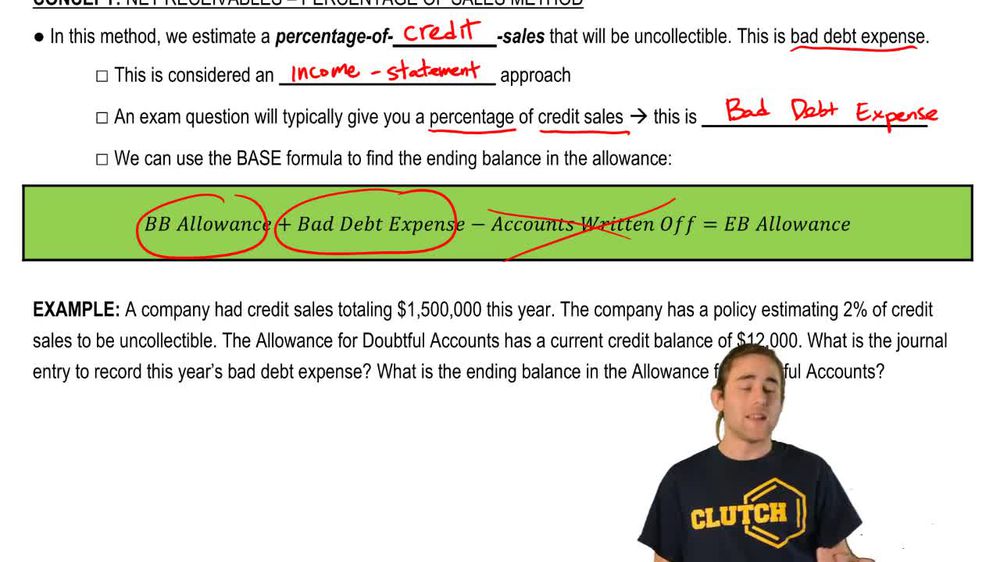

Net Accounts Receivable: Percentage of Sales Method

7. Receivables and Investments

Net Accounts Receivable: Percentage of Sales Method

Practice this topic

- Open Question

A company had credit sales totaling \$2,000,000 this year. The company has a policy estimating 1.5% of credit sales to be uncollectible. The Allowance for Doubtful Accounts has a current debit balance of \$2,000. What is the journal entry to record this year's bad debt expense? What is the ending balance in the Allowance for Doubtful Accounts?

168views13rank - Multiple ChoiceWhich method for estimating bad debts is based on applying a percentage to each period's net credit sales?85views

- Multiple ChoiceUnder the percentage of sales method for estimating bad debts, which of the following best describes how net accounts receivable is determined at the end of the period?121views

- Multiple ChoiceThe income statement approach for estimating bad debts uses a percentage of which of the following?118views

- Multiple ChoiceWhich of the following formulas is used to calculate 'days sales uncollected'?122views