7. Receivables and Investments

Equity Method

Practice this topic

- Multiple Choice

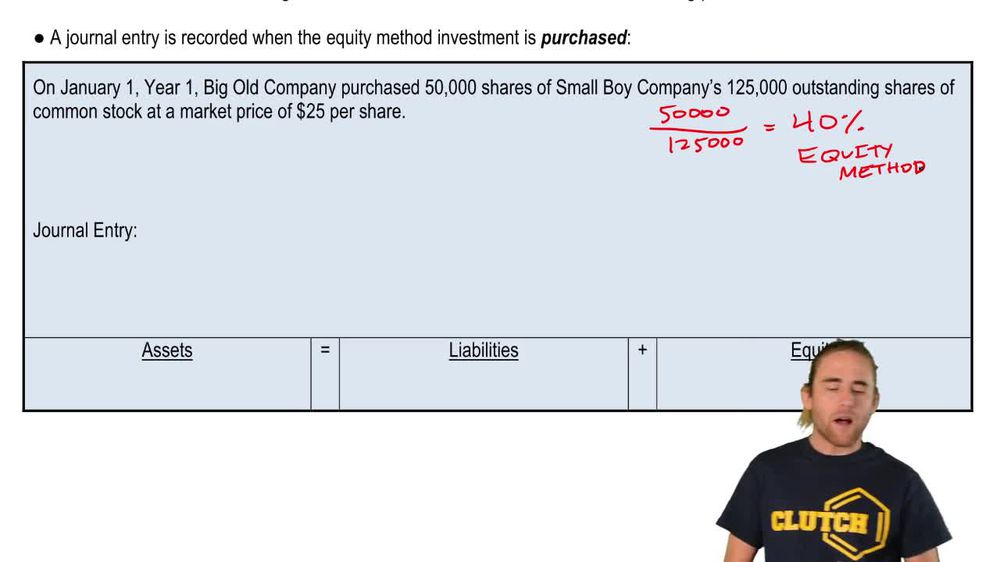

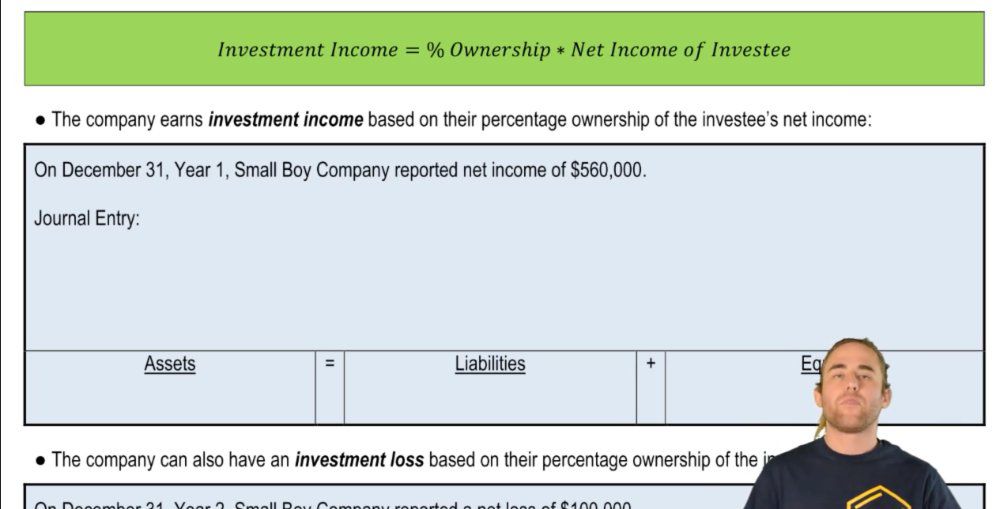

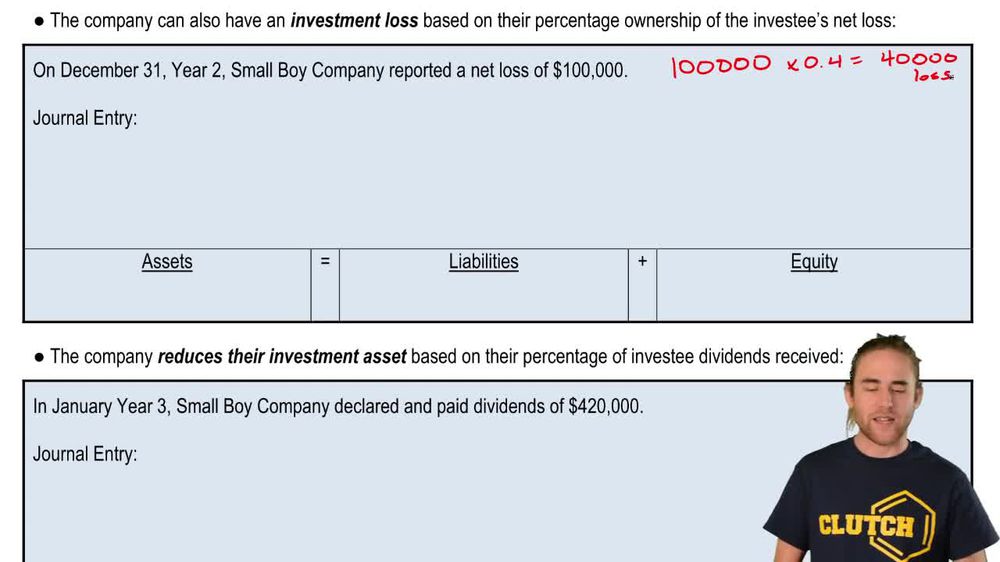

On January 3, Johnson Corp acquired 35% of the outstanding common stock of Small Company for \$350,000. For the year ended December 31, Small Company reported net income of \$150,000 and paid cash dividends of \$70,000 on its common stock. At December 31, the carrying value of Johnson Corp's investment in Small Company under the equity method is:

200views - Multiple Choice

On January 4, The Jones Company purchased 35,000 out of the 87,500 outstanding shares of Miller Company for \$400,000. During the year, the Miller Company reported net income of \$240,000 and paid cash dividends of \$60,000, while the Jones Company reported net income of \$450,000 and paid cash dividends of \$80,000. What is the carrying value of Jones Company's investment in Miller Company at the end of the year under the equity method?

196views - Multiple Choice

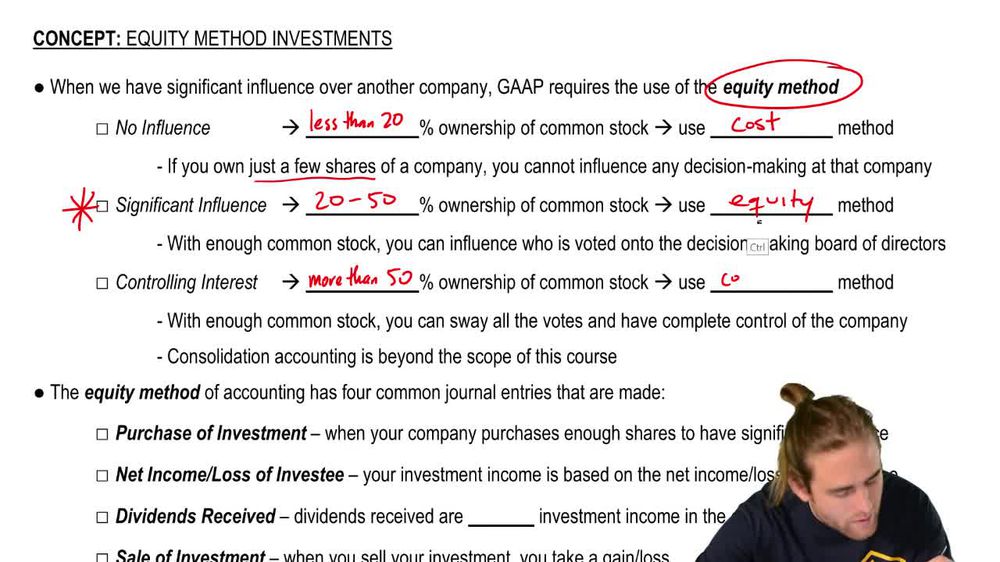

GT Company owns 9,000 of the 48,000 shares of outstanding common stock of Bell Company. GT Company should account for this investment using the:

254views - Multiple ChoiceUnder the equity method, how does an investor account for its share of the investee's net income?153views