Five Money Management Tips for College Students

Budgeting in college can be very hard. With the world at your fingertips, new events every day, and the convenience of fast food, saving money in college almost feels impossible. However, there is hope. With a few quick lifestyle changes, you can easily go from pinching pennies to having enough savings to survive when you graduate.

Keep Track of Your Spending

Some bank apps make it really easy to do this, but even if you just need an excel sheet, keeping track of the money you’re spending can be a gamechanger. When you are constantly writing down what you're spending, it causes you to be more cautious of how much you are spending monthly. Suddenly, a $7 coffee every other day doesn’t seem as tempting, and eating in allows you to spend more money in the long run-on things/experiences that will mean more to you than the late-night Canes run. Pick and choose what’s more important and keep track of what your weekend meals add up to.

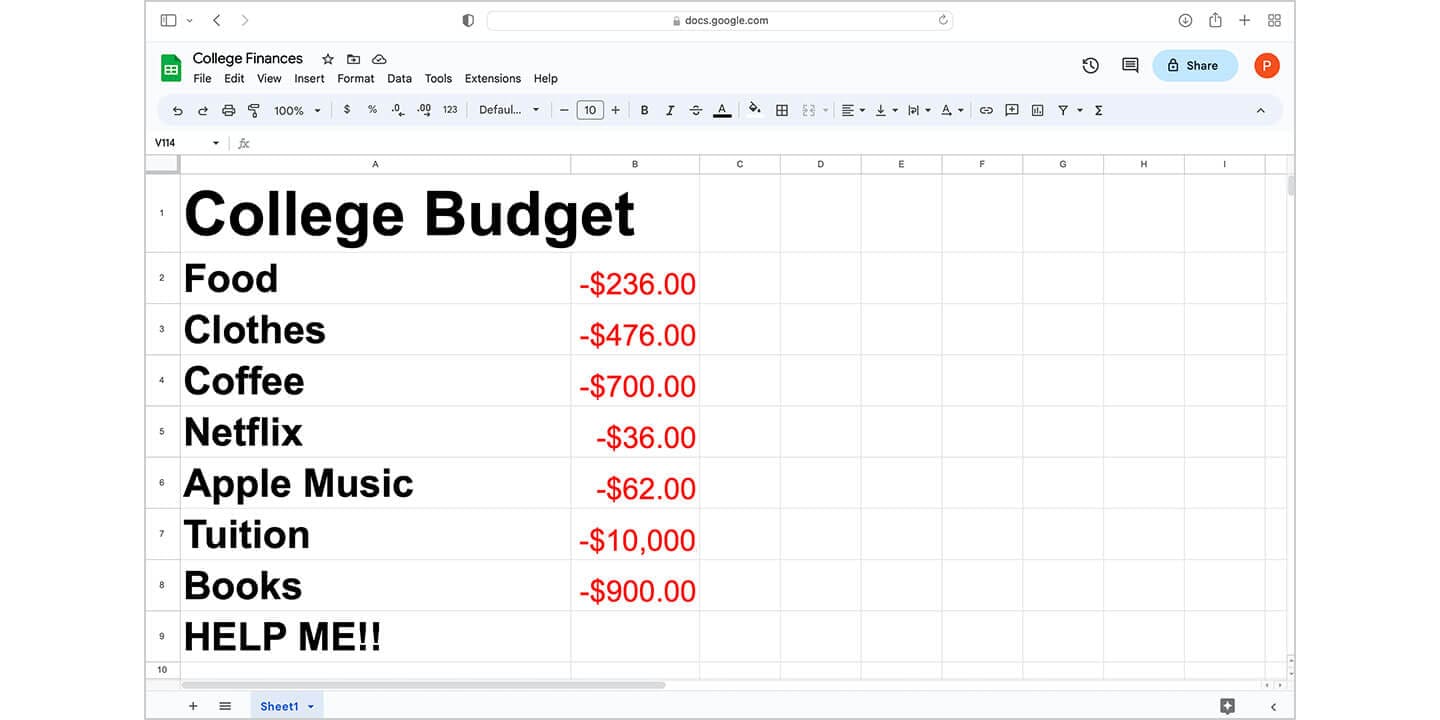

Set A STRICT Budget

And no, this doesn’t mean transferring money out of your savings every time your monthly budget runs dry. In order to save money in college, you have to create a budget and stick to it. My rule of thumb is 40% savings, 60% checking, then dividing that up into gas, groceries, bills, wants, and needs. The important thing is sticking to what you have set at the beginning of the month and not going over it. When you go over, you are already setting yourself up for a bad month to follow. When you go under, you’re able to spend more money where you want to in the coming months.

Be Intentional

It is so easy to spend money when you aren’t thinking about it. Small purchases for $5 or $10 can seem like nothing, but then all of a sudden you’ve spent $100 in one weekend, and you didn’t actually enjoy most of it. It’s so important to spend intentionally, buying things only when you need or have money to. Window shopping always turns into real shopping, and “looking around” is always too tempting. It’s easier to just not go to the mall than to convince yourself not to spend the money once you’re there.

Take advantage of FREE

People know college kids are struggling. Whenever there’s an event on your campus with free food, take advantage! Eat at the dining hall when you have passed your allotted amount for eating out this month. The food might be less tempting than your favorite take-out place, but this is the one time in your life you will have access to free and made meals, so save that money and suffer through it! Dining hall pizza is always better than being broke.

Give Yourself Grace

My final tip is to give yourself grace when you don’t follow all of this perfectly. We are all struggling with finances, and money seems to never be enough, and it’s ok to have a little less in your checking account than you’d prefer. This is also a time where you can fully focus on being a student with few responsibilities. Go out with friends, make memories, and don’t be so hard on yourself when it comes to your money spending. Maybe just opt for the cheaper restaurants every so often and go thrifting for outfits you’re only going to wear once anyways. That dress is so cute for a Taylor Swift concert but won’t be in your calculus class.

Overall, college is hard enough, and not having enough money to feel comfortable with your spending makes it even harder. Being intentional, limiting your spending, and keeping track of it will make living in college on a small budget easier. But remember that you won’t always do this exactly how you want, and that’s okay. You are doing hard things, and you should celebrate that instead of beating yourself up for spending a little too much on Celsius. Do your best and check your bank account often, and you’ll be okay.

Do you have a compelling story or student success tips you’d like to see published on the Pearson Students blog? If you are a college student and interested in writing for us – click here to pitch your idea and get started!