College Money Management Hacks

“I’m broke!” might just be the most common statement made by college students. College is a major expense, but there are many ways to still have fun and be involved without breaking the bank!

Take Advantage of Student Discounts

Did I hear discounts? Yes! There are many businesses that offer discounts for students. From clothes to electronics to movie theaters to theme parks, retailers are happy to support students. Don't be afraid to ask about available student discounts.

Apply For Scholarships

I know it can seem daunting to write essay after essay about why you deserve a scholarship, but organizations want to help students with their financial needs! Sitting down for a couple of hours and submitting applications can make all the difference to offset college costs... and some scholarships don’t even require essays! Make sure that you check with your school’s financial aid office for specific scholarships related to academic performance, athletics, or extracurriculars.

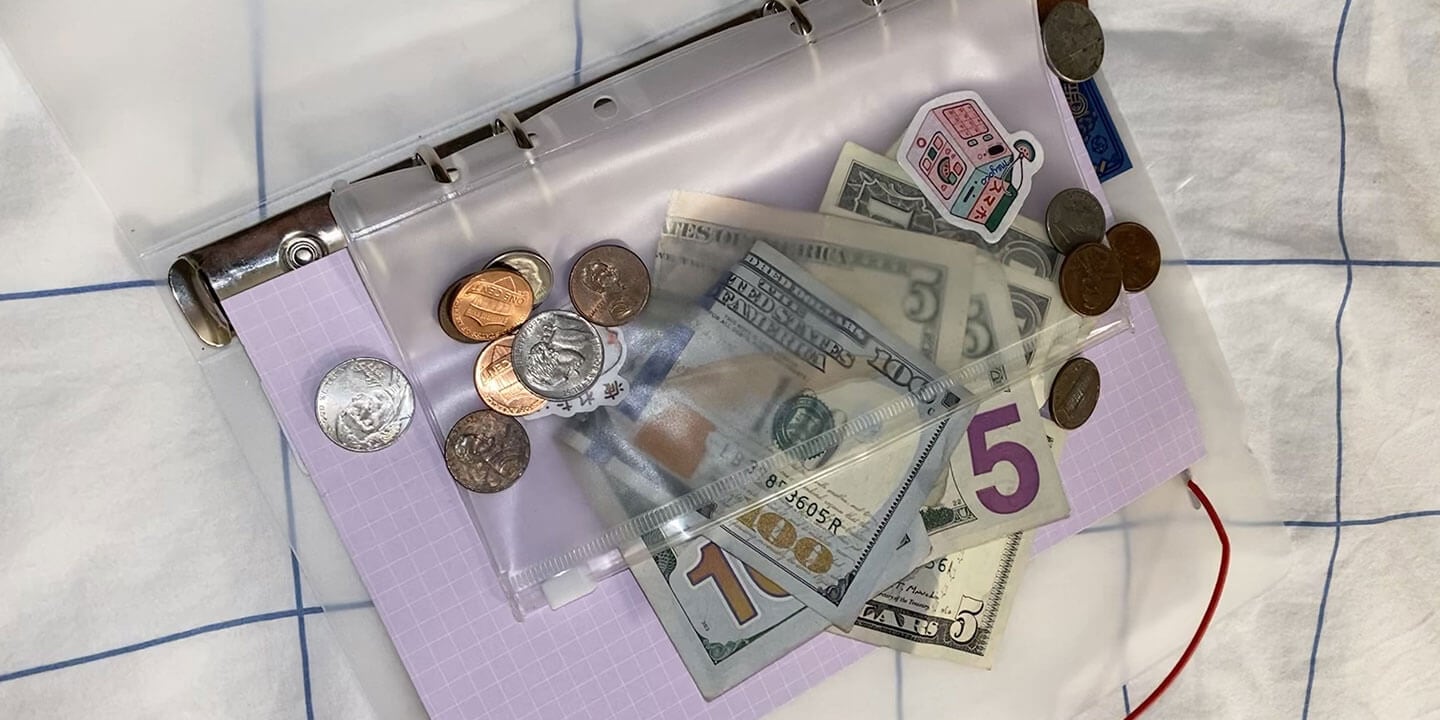

Give Yourself an Allowance

Learning how to balance your spending is an important life skill. If you have a job, calculate how much money you make per month and allow yourself a maximum amount to spend out of your income. If you do not have a job, allot a specific amount you can spend each month or consider finding a job on campus if you have enough time in your schedule. There are usually many opportunities to work at on-campus coffee shops, the library, or dining halls. Check out your school’s employment opportunities for more information. Be sure to track your spending and progress for motivation!

Open A Savings Account

A savings account is a great way to store your money in a secure location, limit spending (remember your allowance!), and earn interest. Keeping your savings in an account ensures access to your funds in case of an emergency, while intentionally separating your spending money from what you are trying to save. Investigate savings accounts without minimum balance amounts and no monthly fees to save even more.

Investigate E-Textbooks

It is no secret that college textbooks are expensive! Many college textbooks are available in a more budget-friendly eTextbook format – which are often less than half of the cost of the print version. I’ve had the opportunity to subscribe to my eTextbooks, available in Pearson+. This has been a great way to save money on textbooks. For just $10.99/month you have instant access to your eTextbook, videos, and study tools. With the Pearson+ mobile app, you can access your textbooks from anywhere!

Your college years can be challenging in many ways and managing finances can top the list at times. Take the time to plan the money management strategies that work best for you. The habits you build will serve you well both throughout your college experience and after graduation.

Do you have a compelling story or student success tips you’d like to see published on the Pearson Students blog? If you are a college student and interested in writing for us – click here to pitch your idea and get started!