Post Secondary Investment Prowess

With the steadily rising cost of tuition, it is becoming increasingly vital to understand the financial implications of pursuing a degree after high school. From the year 2000 to 2021, the average cost of tuition for four-year schools was driven up by 69% due to a variety of economic factors. But what does this mean for those currently enrolled in, or applying to pursue, a four-year degree? The bottom line is that when it comes to considering going to college, education is an investment and must be tackled as such – especially if you intend on taking out loans.

Disclaimer: The information provided on this blog is for general informational purposes only. It does not constitute financial advice and should not be relied upon as such. Before making any financial decisions, you should consult with a qualified financial advisor who can assess your situation.

The process of funding your college degree will vary drastically depending on your situation. Moving to a university to study will generally be expensive for many; however, scholarships and grants are given based on high school academic performance (GPA, standardized tests), extracurriculars (sports, clubs), and financial need. Beyond these, there are many other ways to support your expenses before relying on debt.

Applying for a job sounds obvious, but many students shy away from the idea. I have spoken to many college students who are under the impression that working on campus is a threat to their education, consuming time and adding more tension to the already burdensome schedule of a college student. While this may be true in some cases, there are plenty of opportunities out there that offer a flexible work environment while supporting a student in their education.

“Work Study”, or FWS, is a need-based federal program that aims to support students financially while allowing them to gain valuable work experience. In my experience, I’ve seen work-study students employed in administrative departments, gyms, and other facilities. The program is based on the idea that eligible students are on a full-time schedule which is reflected in the flexibility of scheduling. More information can be found on studentaid.gov.

Alternative sources of employment can also include remote work or part-time shifts at surrounding campus businesses. It is possible to find remote work through LinkedIn and other career platforms that can support a flexible work schedule. Personally, working as a Campus Ambassador for Pearson gives me a chance to support my college life while working on campus. To explore opportunities that you may be eligible for, it is worth a visit to your university career center for advice on how to apply and prepare for recruitment. Additionally, businesses on or near your campus may be looking for help. It is worth stopping at local companies you are interested in working for or have prior experience with to see if they are looking for part-time employees. Moreover, if you work a summer job, saving most of your income will benefit you during the year as well.

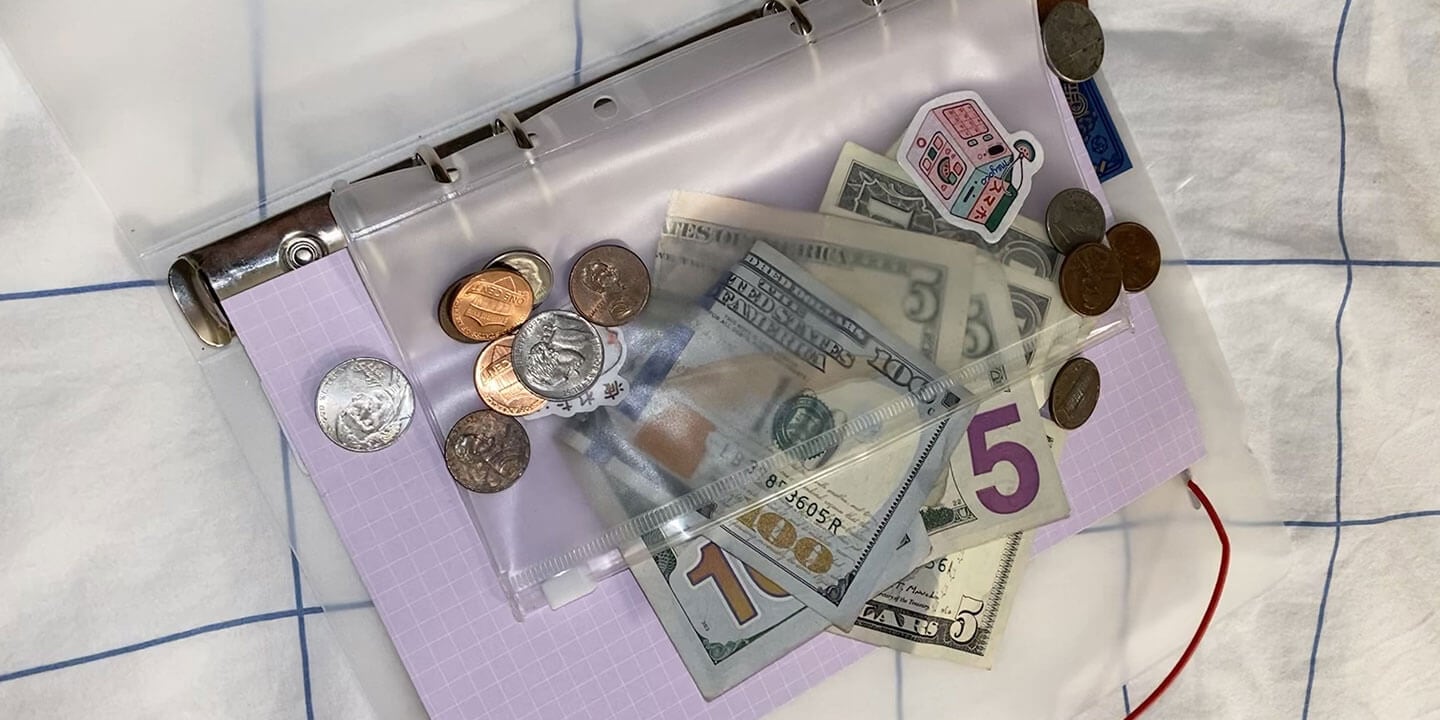

Another way to look at covering the cost is if you can’t increase your income, decrease your spending. There are many ways to do this, but I would recommend:

- Tracking your monthly expenses

- Prioritizing essentials

- Limiting dining out, entertainment, and shopping

- Cooking at home

These are four habits that have allowed me to fund a significant portion of my college experience myself. However, it is also important to create a healthy balance to make the most out of your college experience. Understand that violating your budget in college occasionally is often negligible and sometimes inevitable – it is the habits that stick. Ultimately, that idea goes for both sides of the coin. As I learned in my finance classes, compounding has drastic effects in the long run. Therefore, making consistently wise financial decisions is a key step in obtaining a college degree.

Do you have a compelling story or student success tips you’d like to see published on the Pearson Students blog? If you are a college student and interested in writing for us – click here to pitch your idea and get started!