Invest in Yourself: Saving Money in College

When in college, it may seem impossible to save money. There are countless things you’ll want to spend your cash on, whether it’s a football game, a club membership, or shopping for the next event. On top of that, you still have to account for what you need for both school and life.

Managing all of this can feel overwhelming, especially if it’s your first time living away from home. That’s why it’s so important to be intentional and find a healthy balance in everything from your schedule to your spending.

Get Started: Earning an Income

To manage money effectively, you have to first have some money to work with. Whether it comes from an allowance, a scholarship, or a part-time job, having a reliable source of income is essential.

The more you can earn, the more you can save. If you keep your savings in an account that earns interest, this money will grow alongside you through college. Figuring out how much you make each month is the critical first step to establishing good spending and saving habits.

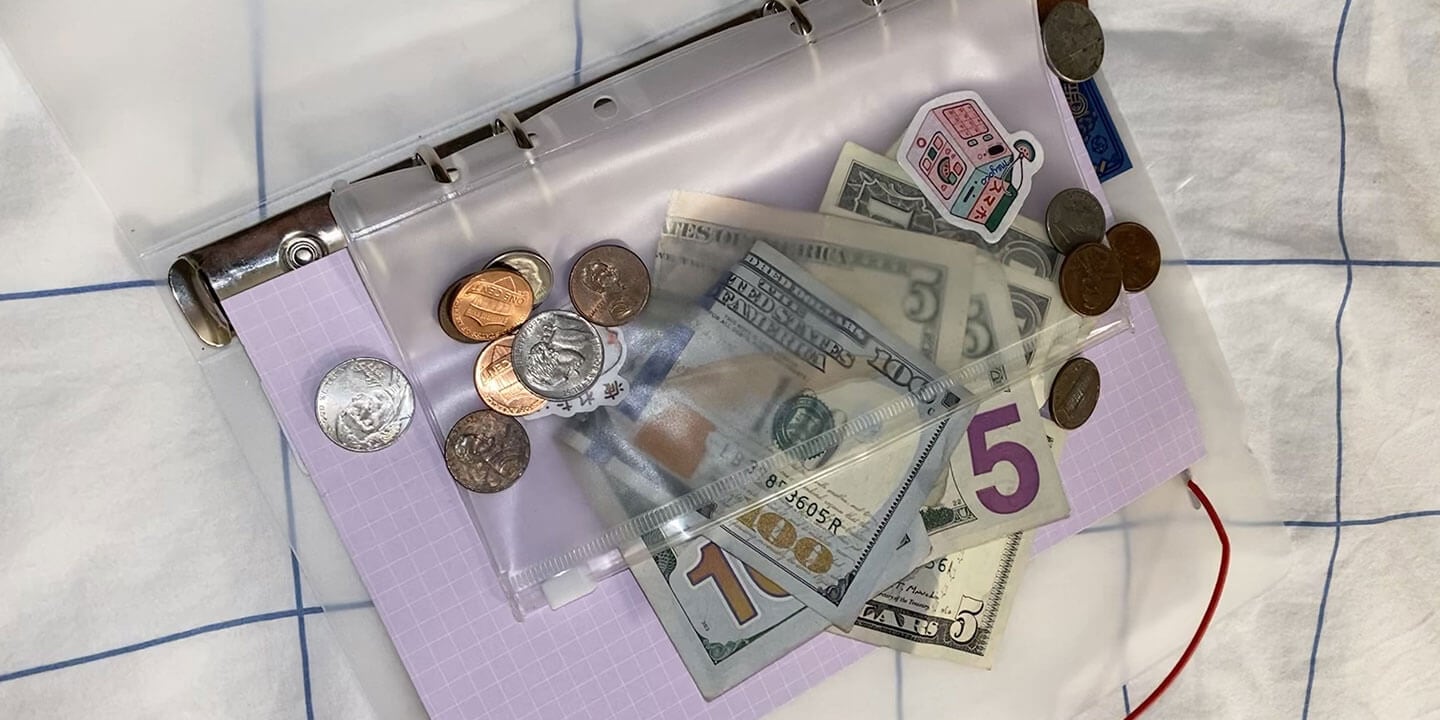

Get Organized: Managing a Budget

Once you know your monthly income, the next step is to allocate your money wisely. Start by setting aside funds for necessities like food and rent. Then, with the remaining balance, create a realistic budget for your wants and savings.

For instance, if you have $500 left after covering your essential expenses, decide how much you want to save. If you choose to save $200, you’ll have $300 left to cover all other expenses. The key takeaway is to save before you spend.

Save Money: Spend Thoughtfully

It might be difficult to save the same amount every month, because college is full of unique experiences that entice with the promise of memories (and the price of mementos). However, by prioritizing essentials first, then savings, and finally discretionary spending, you can manage your money more effectively and avoid unnecessary debt.

At the end of the day, we’re still young adults balancing the excitement and responsibility of adulthood. While it’s important to enjoy college life, the most critical aspect of managing money is to plan and prepare for the future.

Yes, having fun is important, but at the end of the day, a lot of the fun we experience in college is fleeting. Make sure you stay focused on long-term growth without getting (too) distracted by short-term rewards.

Invest: In Yourself

As you progress through school, challenge yourself to save as much as possible. The earlier you develop this habit, the more you’ll earn in interest.

Ultimately, the goal of pursuing a degree is to transition into a successful, self-sufficient adult. Use this time to invest in yourself in every way: academically, professionally, personally, and financially. It will pay off (literally) in the long run.

Do you have a compelling story or student success tips you’d like to see published on the Pearson Students blog? If you are a college student and interested in writing for us – click here to pitch your idea and get started!