Four Money Management Tips for College Students

College is an important time in many people’s lives. For some, it is the first time they live independently and have bills to pay. The habits you form in college will impact your habits in the future, especially when it comes to money management. It is important to develop good practices and habits when it comes to your finances because what you do in college can either put you ahead in life or hold you back. Here are four topics to think about and/or actions to take while in college that will prepare you for the future.

Understand Student Loans

We can’t talk about how to effectively manage money in college without talking about student loans. Too many students go to college and agree to take out loans, without knowing the terms of the loans or realizing the impact these loans can have on them later in life. Every college student should work part time to make some money and gain work experience. You should aim to pay for as much of your living and tuition expenses as possible.

Once you have a job and steady income, you can decide whether you will need to take out student loans, and, if you do, how much you should take out. Pay close attention to the interest rates on loans if you do take them out. Look for loans that have less than 5% interest rates. If interest rates are over 5%, you should try to look at alternative options. Generally, federal loans will have much lower interest rates than private loans and you should look here first. Additionally, you can look for opportunities such as scholarships and grants to help pay for the costs of college.

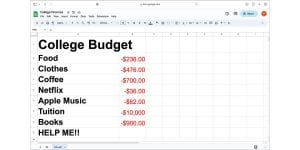

Brains in Budgeting

While working part time in college and paying bills, you should begin to track your income and expenses. This is generally referred to as a budget or cash flow analysis. You can make a budget in Excel, on a Google spreadsheet, on paper, or you can use a budgeting app such as Mint, Personal Capital, or EveryDollar.

When making a budget, you will want to split it into income and expenses. In the income section, list the paychecks you receive from work, income from side hustles and investments (if applicable), and cash gifts. In the expenses section, choose categories that apply to your situation such as housing, utilities, transportation, food, etc. Once you have chosen your categories you can add subcategories underneath. For example, rent and household supplies could go under housing; electricity, water, and internet could go under utilities; gas and car insurance could go under transportation; and groceries and eating out could go under food. It is important to track your income and expenses, so you know where your money is going.

Build an Emergency Fund

If you have discretionary income remaining after paying for living expenses and tuition, focus on building an emergency fund with 3-6 months of expenses. This will ensure that you are still able to pay your tuition and bills in case you are between jobs. You can keep your emergency fund in a money market or high yield savings account.

Start Investing Now

Once you have a fully funded emergency fund, you can consider investing. The sooner you start investing, the longer your money will have to grow. It is important to get in the habit of saving and investing and this can start in college. Even if you are only able to invest $20 a month, this will start the habit of investing. Since you are young and in a low tax bracket, consider opening a Roth IRA so your money can grow tax-free. You can open a Roth IRA at a brokerage firm such as Fidelity or Vanguard. I recommend investing in a total stock market index fund and putting in the same amount of money each month.

Doing things such as minimizing student loan debt, budgeting, building an emergency fund, and investing in college can help put you ahead in life and set you up for success in the future. It is important to build these habits in college so you can graduate in a good financial position and be prepared to manage more money after college when you are working full time and no longer must pay for school. If you can learn and implement these important lessons in college, you will look back one day and be glad that you started early.

Do you have a compelling story or student success tips you’d like to see published on the Pearson Students blog? If you are a college student and interested in writing for us – click here to pitch your idea and get started!

About the author

Matthew Dougherty

Matthew Dougherty is a sophomore at the University of North Florida majoring in Finance and Financial Planning. He is currently working as a Finance and Economics Tutor at UNF, a Campus Ambassador at Pearson, and an intern at Farther Finance. He will be starting an internship with Fidelity Investments over the summer. Matthew is passionate about helping other people with their finances. He believes that if you get money out of the way, then you can focus on other important areas of your life. In his free time, Matthew enjoys reading, sports, hiking, and spending time with family and friends.