How to Get a Quick Start to Saving

As I’m nearing the end of my undergraduate career, I’ve realized there are so many things I want to do, and it seems like they all require money. It’s incredibly hard to save money when you’re a student working minimum wage, especially when you’re experiencing “adult money” for the first time.

When I got my first job, I spent my first paycheck almost immediately. This was money I earned for myself and wouldn’t feel bad for my parents when I used it. This mindset made it so my paychecks were wrung dry hundreds of times faster than the amount of time I spent to earn that money. The money wouldn’t last, and I’d use it on large handfuls of small daily purchases like coffee or boba. My poor money spending decisions left my pockets empty and I began to realize I would never reach my larger goals, such as going on an international trip or affording my own place, unless I figured out a way to start saving.

Time is Money

What I began to do to save money included changing my mindset, purchases, and “piggy bank”. Let’s say I make $15 an hour and a single drink at a cafe costs around $5, sometimes much more. I realized that buying only three drinks would translate to me working for one hour. Once I started looking at purchases in terms of my time and effort, I made less of the unnecessary “luxury” purchases.

Buy in Bulk

Another thing I would do is buy “in bulk”. Rather than buying one drink, I’d buy the ingredients for it and make it myself. The $20 spent on 4 cups of coffee could be stretched further on groceries that would equate to a month’s worth of coffees.

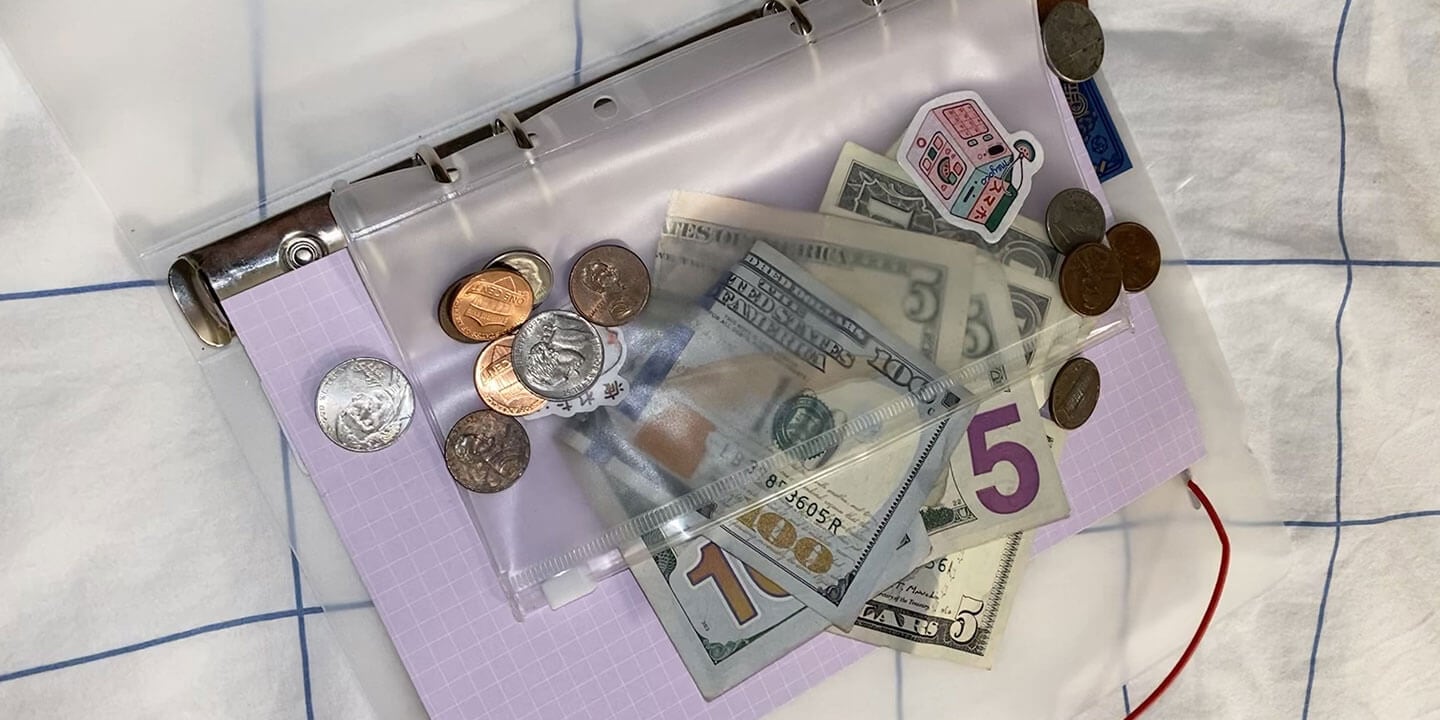

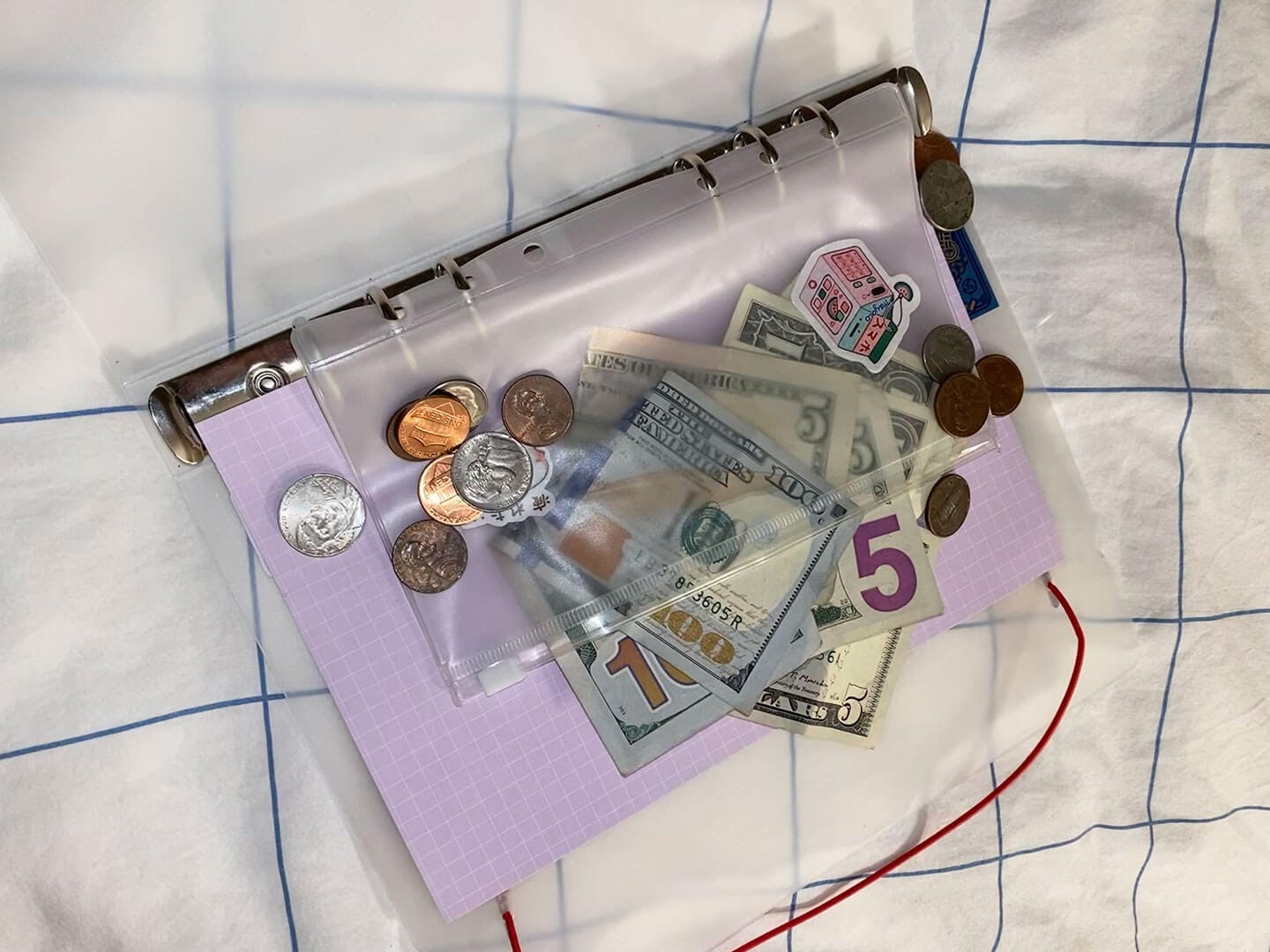

Cut the Card and Correct with Cash

I also noticed that my primary mode of payment was my bank card, which made it too easy to overspend. I’ve rarely carried cash since the start of the pandemic, so I began to go to my bank and take cash out of my accounts. I’d then take the cash and place it in a small notebook that I keep out of sight. It helps to get newer dollar bills that are fresh and clean. It makes me want to keep them! By doing this I prevent myself from spending the money that is locked away in my room, and I occasionally even forget about it which makes for a nice surprise later. This action helped me curb my online spending, too.

These are small changes in my lifestyle that have resulted in a satisfying savings amount, and I look forward to seeing how much I can save up by the end of the year.

Do you have a compelling story or student success tips you’d like to see published on the Pearson Students blog? If you are a college student and interested in writing for us – click here to pitch your idea and get started!

About the author

Kaitlin Hung

Kaitlin Hung is studying Cell, Molecular, Developmental Biology at University of California, Riverside. In her free time, she enjoys learning about other cultures and spending time with friends. She is a Pearson Campus Ambassador and is grateful for the opportunities she has had to meet new people through this role.