Mergers occur when two separate firms combine to form a single entity, and they can significantly impact market dynamics. There are two primary types of mergers: horizontal and vertical. Horizontal mergers involve firms within the same industry, which can raise concerns about reduced competition. A notable example is the attempted merger between AT&T and T-Mobile, which was ultimately blocked by the government due to fears it would diminish competition and increase market power.

In contrast, vertical mergers occur between firms at different stages of production. A classic example is eBay's acquisition of PayPal, which allowed eBay to streamline transactions by eliminating the need for a third-party payment processor. The government tends to scrutinize horizontal mergers more closely than vertical ones, as the former poses a greater risk to competitive market structures.

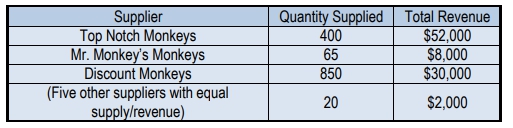

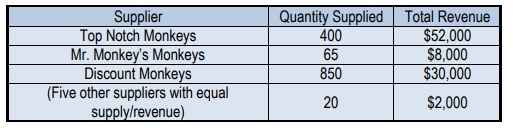

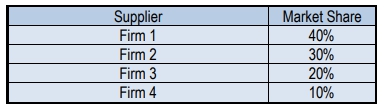

To assess the potential impact of a merger on market competition, the government utilizes the Herfindahl-Hirschman Index (HHI). This index measures market concentration, which reflects the degree of market power firms hold and their ability to influence prices. The HHI is calculated by squaring the market share of each firm in the industry and summing these values. For instance, if a firm has a 20% market share, it contributes \(20^2 = 400\) to the HHI.

The interpretation of HHI values is crucial for understanding market concentration. An HHI below 1500 indicates a low concentration level, suggesting that mergers are generally permissible without significant concerns about competition. An HHI between 1500 and 2500 signifies moderate concentration, prompting the government to exercise caution regarding potential mergers. An HHI above 2500 indicates a highly concentrated market, leading to increased scrutiny and potential restrictions on mergers to protect competitive practices.