When a tax is imposed on a market, it generates tax revenue for the government, which can be calculated using the formula:

Tax Revenue = Tax Amount × Quantity Sold

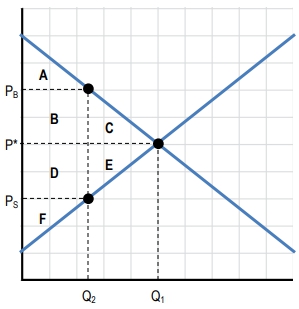

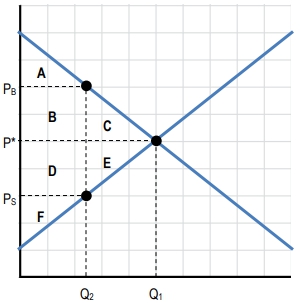

Here, the quantity sold is the quantity exchanged at the tax, denoted as \( Q_T \). This tax revenue can be visually represented as a rectangle on a graph, where one side represents the tax amount and the other side represents the quantity sold at the taxed price.

Imposing a tax disrupts market equilibrium, leading to different prices for buyers and sellers. This shift results in a loss of economic surplus, which is the sum of consumer surplus and producer surplus. The loss of surplus due to the tax is referred to as deadweight loss, represented by the area of trades that no longer occur because the market is not operating at equilibrium.

To understand the impact of a tax, we can compare the market with and without a tax. In a tax-free market, equilibrium is achieved at price \( P^* \) and quantity \( Q^* \). Consumer surplus is the area above the price and below the demand curve, encompassing areas A, B, and C. Producer surplus is the area below the price and above the supply curve, represented by areas D, E, and F. The total economic surplus is maximized in this scenario, as all surplus is allocated efficiently.

When a tax is introduced, consumer surplus decreases significantly. The new consumer surplus is only area A, as areas B and C are lost due to the tax. Similarly, producer surplus is reduced to area F, losing areas D and E. The tax revenue generated is represented by the rectangle formed by areas B and D, indicating a transfer of surplus from consumers and producers to the government.

Despite the loss of consumer and producer surplus, the total economic surplus now includes tax revenue, calculated as A + B + D + F. However, the overall economic surplus is still diminished because areas C and E are no longer part of the surplus. The deadweight loss, represented by areas C and E, signifies the trades that do not occur due to the tax, leading to an inefficient allocation of resources.

In summary, the imposition of a tax alters the dynamics of market equilibrium, resulting in reduced consumer and producer surplus, increased tax revenue, and the creation of deadweight loss. Understanding these effects is crucial for analyzing market efficiency and the implications of taxation on economic welfare.