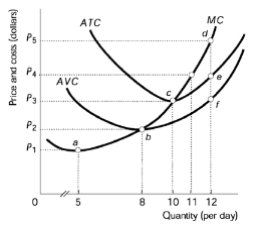

In a perfectly competitive market, firms may face situations where they are unable to cover their costs, leading to potential shutdown decisions. A firm may choose to shut down temporarily when market prices fall below the level necessary to cover variable costs, or when their operational costs become unsustainable. This decision is distinct from exiting the market entirely; a shutdown indicates a temporary halt in production, while an exit signifies a permanent departure from the market.

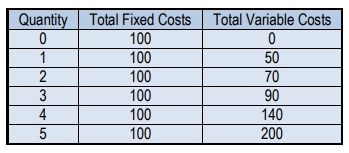

Understanding the difference between short-run and long-run decisions is crucial. In the short run, firms encounter fixed costs that must be paid regardless of production levels. These fixed costs remain constant and do not influence the decision to shut down. Instead, the focus shifts to variable costs, which are incurred only when production occurs. If a firm's revenue does not exceed its variable costs, it may opt to shut down to minimize losses.

The concept of sunk costs plays a significant role in this decision-making process. A sunk cost refers to an expense that has already been incurred and cannot be recovered. For instance, if a firm has paid rent for a factory, that cost remains regardless of whether the firm continues to produce. Similarly, personal commitments, such as lease agreements, exemplify sunk costs, as they bind individuals to payments that cannot be recouped. Recognizing sunk costs is essential for firms to make rational decisions about continuing operations or shutting down temporarily.

In summary, the decision to shut down is influenced by current market conditions and the relationship between variable costs and revenue. Firms must carefully evaluate their financial situation, considering both fixed and variable costs, to determine the most strategic course of action in the short run.