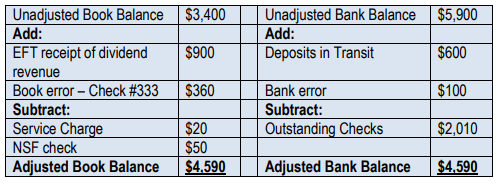

After completing a bank reconciliation, it is essential to make journal entries for all items identified in the book column. This process ensures that the cash account accurately reflects all transactions that have occurred but were not previously recorded.

When a bank collects money on behalf of a business, typically from a customer, the journal entry involves debiting cash to reflect the increase in cash received and crediting accounts receivable (AR) to decrease the amount owed by the customer. This entry can be summarized as:

Debit: Cash (amount)Credit: Accounts Receivable (amount)

Similarly, for electronic funds transfers (EFT), if cash is received from a customer, the entry remains the same as for bank collections. However, if the EFT involves a payment made to a vendor, the entry would debit accounts payable to reduce the liability and credit cash to reflect the outflow of cash:

Debit: Accounts Payable (amount)Credit: Cash (amount)

In cases where the bank charges a service fee, the business must recognize this as an expense. The journal entry would debit a bank fee expense account to increase the expense and credit cash to account for the reduction in cash due to the fee:

Debit: Bank Fee Expense (amount)Credit: Cash (amount)

When the bank pays interest on the business's balance, the entry involves debiting cash for the amount received and crediting interest revenue, reflecting the income earned during the period:

Debit: Cash (amount)Credit: Interest Revenue (amount)

Handling not sufficient funds (NSF) checks requires reversing the initial entry made when the check was received. If a check bounces, the business must debit accounts receivable to reinstate the amount owed by the customer and credit cash to reflect the decrease in cash that was previously recorded:

Debit: Accounts Receivable (amount)Credit: Cash (amount)

Lastly, for book errors, the business must identify the incorrect entry and make the necessary adjustments to correct it. This involves determining the original entry and the correct entry, then adjusting the accounts accordingly to remove the effects of the error.

By accurately recording these journal entries, businesses can maintain precise financial records that reflect their true cash position and outstanding receivables.