Suppose a least-squares regression line is given by ŷ = 4.302x – 3.293. What is the mean value of the response variable if x = 20?

Table of contents

- 1. Intro to Stats and Collecting Data1h 14m

- 2. Describing Data with Tables and Graphs1h 55m

- 3. Describing Data Numerically2h 5m

- 4. Probability2h 16m

- 5. Binomial Distribution & Discrete Random Variables3h 6m

- 6. Normal Distribution and Continuous Random Variables2h 11m

- 7. Sampling Distributions & Confidence Intervals: Mean3h 23m

- Sampling Distribution of the Sample Mean and Central Limit Theorem19m

- Distribution of Sample Mean - Excel23m

- Introduction to Confidence Intervals15m

- Confidence Intervals for Population Mean1h 18m

- Determining the Minimum Sample Size Required12m

- Finding Probabilities and T Critical Values - Excel28m

- Confidence Intervals for Population Means - Excel25m

- 8. Sampling Distributions & Confidence Intervals: Proportion2h 10m

- 9. Hypothesis Testing for One Sample5h 9m

- Steps in Hypothesis Testing1h 6m

- Performing Hypothesis Tests: Means1h 4m

- Hypothesis Testing: Means - Excel42m

- Performing Hypothesis Tests: Proportions37m

- Hypothesis Testing: Proportions - Excel27m

- Performing Hypothesis Tests: Variance12m

- Critical Values and Rejection Regions28m

- Link Between Confidence Intervals and Hypothesis Testing12m

- Type I & Type II Errors17m

- 10. Hypothesis Testing for Two Samples5h 37m

- Two Proportions1h 13m

- Two Proportions Hypothesis Test - Excel28m

- Two Means - Unknown, Unequal Variance1h 3m

- Two Means - Unknown Variances Hypothesis Test - Excel12m

- Two Means - Unknown, Equal Variance15m

- Two Means - Unknown, Equal Variances Hypothesis Test - Excel9m

- Two Means - Known Variance12m

- Two Means - Sigma Known Hypothesis Test - Excel21m

- Two Means - Matched Pairs (Dependent Samples)42m

- Matched Pairs Hypothesis Test - Excel12m

- Two Variances and F Distribution29m

- Two Variances - Graphing Calculator16m

- 11. Correlation1h 24m

- 12. Regression3h 33m

- Linear Regression & Least Squares Method26m

- Residuals12m

- Coefficient of Determination12m

- Regression Line Equation and Coefficient of Determination - Excel8m

- Finding Residuals and Creating Residual Plots - Excel11m

- Inferences for Slope31m

- Enabling Data Analysis Toolpak1m

- Regression Readout of the Data Analysis Toolpak - Excel21m

- Prediction Intervals13m

- Prediction Intervals - Excel19m

- Multiple Regression - Excel29m

- Quadratic Regression15m

- Quadratic Regression - Excel10m

- 13. Chi-Square Tests & Goodness of Fit2h 21m

- 14. ANOVA2h 28m

12. Regression

Linear Regression & Least Squares Method

Problem 12.3.19d

Textbook Question

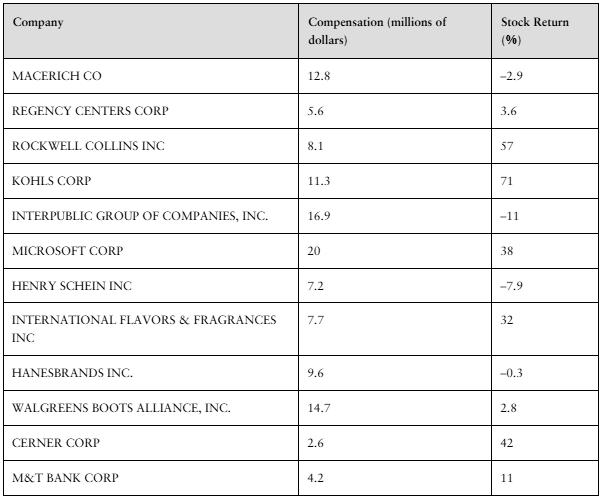

[DATA] CEO Performance (Refer to Problem 33 in Section 4.1) The following data represent the total compensation for 12 randomly selected chief executive officers (CEOs) and the company’s stock performance in 2017.

d. Based on your results to parts (b) and (c), would you recommend using the least-squares regression line to predict the stock return of a company based on the CEO’s compensation? Why?

Verified step by step guidance

Verified step by step guidance1

Step 1: Review the results from parts (b) and (c), which likely include the least-squares regression line equation and the correlation coefficient (r) or coefficient of determination (r^2). These statistics summarize the relationship between CEO compensation and stock return.

Step 2: Interpret the correlation coefficient (r) or r^2 value to understand the strength and direction of the linear relationship. A value close to 1 or -1 indicates a strong linear relationship, while a value near 0 indicates a weak relationship.

Step 3: Examine the residuals or any diagnostic plots (if available) to check for patterns that might violate the assumptions of linear regression, such as non-linearity, heteroscedasticity, or outliers.

Step 4: Consider the practical significance of the regression line. Even if the statistical relationship is significant, assess whether the CEO compensation is a meaningful predictor of stock return based on the size of the slope and the variability explained.

Step 5: Based on the above analyses, decide whether the least-squares regression line is appropriate for prediction. If the relationship is weak, residuals show patterns, or the model explains little variability, it would not be recommended to use the regression line for prediction.

Verified video answer for a similar problem:

Verified video answer for a similar problem:This video solution was recommended by our tutors as helpful for the problem above

Video duration:

2mPlay a video:

Was this helpful?

Key Concepts

Here are the essential concepts you must grasp in order to answer the question correctly.

Least-Squares Regression Line

The least-squares regression line is a statistical method used to model the relationship between two variables by minimizing the sum of the squares of the vertical distances of the points from the line. It helps predict the value of a dependent variable based on an independent variable. In this context, it predicts stock return based on CEO compensation.

Recommended video:

Guided course

Intro to Least Squares Regression

Correlation and Strength of Relationship

Correlation measures the strength and direction of a linear relationship between two variables, ranging from -1 to 1. A strong correlation indicates that the regression line is a good predictor, while a weak correlation suggests poor predictive power. Understanding correlation helps assess if CEO compensation is related to stock return.

Recommended video:

Guided course

Correlation Coefficient

Residuals and Model Appropriateness

Residuals are the differences between observed values and predicted values from the regression line. Analyzing residuals helps determine if the model fits well or if there are patterns indicating poor fit. Large or systematic residuals suggest the least-squares regression line may not be appropriate for prediction.

Recommended video:

Guided course

Residuals and Residual Plots

7:01m

7:01mWatch next

Master Intro to Least Squares Regression with a bite sized video explanation from Patrick

Start learningRelated Videos

Related Practice

Textbook Question

18

views