[DATA] Bull and Bear Markets The stock market goes through periods known as bull markets and bear markets. A bull market exists when the stock market increases in value by at least 20%, while a bear market exists when the stock market decreases in value by at least 20%. The data below represent the number of months a random sample of bull and bear markets have lasted.

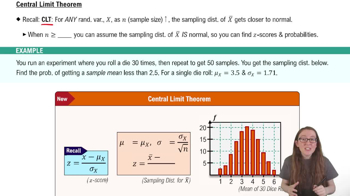

. Although both distributions are skewed, it is likely reasonable to invoke the Central Limit Theorem and conclude the sample mean difference is approximately normal due to the fact the sample size is 25 for each sample. Plus, the two-sample t-test is robust so minor departures from the normality condition are acceptable. In light of this, perform a two-sample t-test on the data. What is the P-value for this test?