Graphical Analysis In Exercises 13 and 14, use the box-and-whisker plot to identify the five-number summary.

Table of contents

- 1. Intro to Stats and Collecting Data1h 14m

- 2. Describing Data with Tables and Graphs1h 55m

- 3. Describing Data Numerically2h 5m

- 4. Probability2h 16m

- 5. Binomial Distribution & Discrete Random Variables3h 6m

- 6. Normal Distribution and Continuous Random Variables2h 11m

- 7. Sampling Distributions & Confidence Intervals: Mean3h 23m

- Sampling Distribution of the Sample Mean and Central Limit Theorem19m

- Distribution of Sample Mean - Excel23m

- Introduction to Confidence Intervals15m

- Confidence Intervals for Population Mean1h 18m

- Determining the Minimum Sample Size Required12m

- Finding Probabilities and T Critical Values - Excel28m

- Confidence Intervals for Population Means - Excel25m

- 8. Sampling Distributions & Confidence Intervals: Proportion2h 10m

- 9. Hypothesis Testing for One Sample5h 9m

- Steps in Hypothesis Testing1h 6m

- Performing Hypothesis Tests: Means1h 4m

- Hypothesis Testing: Means - Excel42m

- Performing Hypothesis Tests: Proportions37m

- Hypothesis Testing: Proportions - Excel27m

- Performing Hypothesis Tests: Variance12m

- Critical Values and Rejection Regions28m

- Link Between Confidence Intervals and Hypothesis Testing12m

- Type I & Type II Errors17m

- 10. Hypothesis Testing for Two Samples5h 37m

- Two Proportions1h 13m

- Two Proportions Hypothesis Test - Excel28m

- Two Means - Unknown, Unequal Variance1h 3m

- Two Means - Unknown Variances Hypothesis Test - Excel12m

- Two Means - Unknown, Equal Variance15m

- Two Means - Unknown, Equal Variances Hypothesis Test - Excel9m

- Two Means - Known Variance12m

- Two Means - Sigma Known Hypothesis Test - Excel21m

- Two Means - Matched Pairs (Dependent Samples)42m

- Matched Pairs Hypothesis Test - Excel12m

- Two Variances and F Distribution29m

- Two Variances - Graphing Calculator16m

- 11. Correlation1h 24m

- 12. Regression3h 33m

- Linear Regression & Least Squares Method26m

- Residuals12m

- Coefficient of Determination12m

- Regression Line Equation and Coefficient of Determination - Excel8m

- Finding Residuals and Creating Residual Plots - Excel11m

- Inferences for Slope31m

- Enabling Data Analysis Toolpak1m

- Regression Readout of the Data Analysis Toolpak - Excel21m

- Prediction Intervals13m

- Prediction Intervals - Excel19m

- Multiple Regression - Excel29m

- Quadratic Regression15m

- Quadratic Regression - Excel10m

- 13. Chi-Square Tests & Goodness of Fit2h 21m

- 14. ANOVA2h 28m

3. Describing Data Numerically

Boxplots

Problem 11.3A.5d

Textbook Question

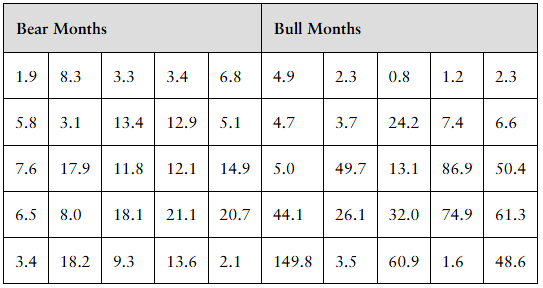

[DATA] Bull and Bear Markets The stock market goes through periods known as bull markets and bear markets. A bull market exists when the stock market increases in value by at least 20%, while a bear market exists when the stock market decreases in value by at least 20%. The data below represent the number of months a random sample of bull and bear markets have lasted.

d. Draw a side-by-side boxplot by market condition. Discuss any interesting features of the graph.

Verified step by step guidance

Verified step by step guidance1

Step 1: Organize the data into two groups based on market condition: Bear Months and Bull Months, as given in the table.

Step 2: For each group, calculate the five-number summary: minimum, first quartile (Q1), median (Q2), third quartile (Q3), and maximum. These values are essential for constructing boxplots.

Step 3: Draw the boxplot for each group side-by-side on the same scale. Each boxplot should have a box from Q1 to Q3, a line at the median, and whiskers extending to the minimum and maximum values (or to the nearest non-outlier values if you identify outliers).

Step 4: Compare the two boxplots by examining their medians, interquartile ranges (IQR = Q3 - Q1), overall range, and any potential outliers. Note differences in central tendency, spread, and skewness between bear and bull market durations.

Step 5: Discuss interesting features such as which market tends to last longer, which has more variability, and whether there are any extreme values or outliers that might affect interpretation.

Verified video answer for a similar problem:

Verified video answer for a similar problem:This video solution was recommended by our tutors as helpful for the problem above

Video duration:

2mPlay a video:

Was this helpful?

Key Concepts

Here are the essential concepts you must grasp in order to answer the question correctly.

Boxplot Construction and Interpretation

A boxplot visually summarizes data distribution through five key statistics: minimum, first quartile (Q1), median, third quartile (Q3), and maximum. It highlights the central tendency, spread, and potential outliers, making it easier to compare groups side-by-side, such as bear and bull market durations.

Recommended video:

Boxplots Example 1

Comparing Distributions

Comparing distributions involves analyzing differences in shape, center, spread, and outliers between groups. Side-by-side boxplots allow direct visual comparison of these features, helping to identify which market condition tends to last longer or has more variability.

Recommended video:

Guided course

Comparing Mean vs. Median

Understanding Market Conditions and Data Context

Bull and bear markets represent periods of rising and falling stock values, respectively, with durations measured in months. Understanding this context helps interpret the data meaningfully, such as recognizing that longer bull markets might indicate sustained growth phases, while bear markets may be shorter but more volatile.

Recommended video:

Introduction to Collecting Data

3:54m

3:54mWatch next

Master Boxplots ("Box and Whisker Plots") with a bite sized video explanation from Patrick

Start learningRelated Videos

Related Practice

Textbook Question

56

views