Ghosts The following table summarizes results from a Pew Research Center survey in which subjects were asked whether they had seen or been in the presence of a ghost. Use a 0.01 significance level to test the claim that gender is independent of response. Does the conclusion change if the significance level is changed to 0.05?

Table of contents

- 1. Intro to Stats and Collecting Data1h 14m

- 2. Describing Data with Tables and Graphs1h 55m

- 3. Describing Data Numerically2h 5m

- 4. Probability2h 16m

- 5. Binomial Distribution & Discrete Random Variables3h 6m

- 6. Normal Distribution and Continuous Random Variables2h 11m

- 7. Sampling Distributions & Confidence Intervals: Mean3h 23m

- Sampling Distribution of the Sample Mean and Central Limit Theorem19m

- Distribution of Sample Mean - Excel23m

- Introduction to Confidence Intervals15m

- Confidence Intervals for Population Mean1h 18m

- Determining the Minimum Sample Size Required12m

- Finding Probabilities and T Critical Values - Excel28m

- Confidence Intervals for Population Means - Excel25m

- 8. Sampling Distributions & Confidence Intervals: Proportion2h 10m

- 9. Hypothesis Testing for One Sample5h 8m

- Steps in Hypothesis Testing1h 6m

- Performing Hypothesis Tests: Means1h 4m

- Hypothesis Testing: Means - Excel42m

- Performing Hypothesis Tests: Proportions37m

- Hypothesis Testing: Proportions - Excel27m

- Performing Hypothesis Tests: Variance12m

- Critical Values and Rejection Regions28m

- Link Between Confidence Intervals and Hypothesis Testing12m

- Type I & Type II Errors16m

- 10. Hypothesis Testing for Two Samples5h 37m

- Two Proportions1h 13m

- Two Proportions Hypothesis Test - Excel28m

- Two Means - Unknown, Unequal Variance1h 3m

- Two Means - Unknown Variances Hypothesis Test - Excel12m

- Two Means - Unknown, Equal Variance15m

- Two Means - Unknown, Equal Variances Hypothesis Test - Excel9m

- Two Means - Known Variance12m

- Two Means - Sigma Known Hypothesis Test - Excel21m

- Two Means - Matched Pairs (Dependent Samples)42m

- Matched Pairs Hypothesis Test - Excel12m

- Two Variances and F Distribution29m

- Two Variances - Graphing Calculator16m

- 11. Correlation1h 24m

- 12. Regression3h 33m

- Linear Regression & Least Squares Method26m

- Residuals12m

- Coefficient of Determination12m

- Regression Line Equation and Coefficient of Determination - Excel8m

- Finding Residuals and Creating Residual Plots - Excel11m

- Inferences for Slope31m

- Enabling Data Analysis Toolpak1m

- Regression Readout of the Data Analysis Toolpak - Excel21m

- Prediction Intervals13m

- Prediction Intervals - Excel19m

- Multiple Regression - Excel29m

- Quadratic Regression15m

- Quadratic Regression - Excel10m

- 13. Chi-Square Tests & Goodness of Fit2h 21m

- 14. ANOVA2h 28m

9. Hypothesis Testing for One Sample

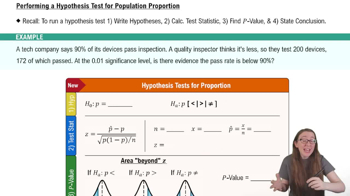

Performing Hypothesis Tests: Proportions

Problem 10.2.31a

Textbook Question

"Small Sample Hypothesis Test: Super Bowl InvestingFrom Super Bowl I (1967) through Super Bowl XXXI (1997), the stock market increased if an NFL team won the Super Bowl and decreased if an AFL team won. This condition held 28 out of 31 years.

a. Suppose the likelihood of predicting the direction of the stock market (increasing or decreasing) in any given year is 0.50. Decide on the appropriate null and alternative hypotheses to test whether the outcome of the Super Bowl can be used to predict the direction of the stock market.

"

Verified step by step guidance

Verified step by step guidance1

Step 1: Identify the parameter of interest. Here, we are interested in the probability \( p \) that the stock market direction can be correctly predicted based on the Super Bowl outcome in any given year.

Step 2: Formulate the null hypothesis \( H_0 \). Since the likelihood of correctly predicting the market direction by chance is 0.50, the null hypothesis assumes that the Super Bowl outcome does not help predict the market direction better than random guessing. Mathematically, \( H_0: p = 0.50 \).

Step 3: Formulate the alternative hypothesis \( H_a \). Because the problem suggests that the market increased 28 out of 31 times when an NFL team won (which is more than expected by chance), the alternative hypothesis should reflect that the probability of correct prediction is greater than 0.50. Thus, \( H_a: p > 0.50 \).

Step 4: Clarify the type of test. Since the alternative hypothesis is one-sided (greater than), this will be a right-tailed test.

Step 5: Summarize the hypotheses clearly: \[ H_0: p = 0.50 \quad \text{vs.} \quad H_a: p > 0.50 \]

Verified video answer for a similar problem:

Verified video answer for a similar problem:This video solution was recommended by our tutors as helpful for the problem above

Video duration:

2mPlay a video:

0 Comments

Key Concepts

Here are the essential concepts you must grasp in order to answer the question correctly.

Null and Alternative Hypotheses

In hypothesis testing, the null hypothesis (H0) represents the default assumption, usually stating no effect or no difference. The alternative hypothesis (H1) reflects the claim we want to test, suggesting an effect or difference exists. Formulating these correctly is essential to guide the statistical test and interpret results.

Recommended video:

Guided course

Step 1: Write Hypotheses

Binomial Probability Model

The binomial model describes the number of successes in a fixed number of independent trials, each with the same probability of success. Here, predicting the stock market direction correctly or incorrectly can be modeled as a binomial process with probability 0.5 under the null hypothesis.

Recommended video:

Guided course

Calculating Probabilities in a Binomial Distribution

Small Sample Hypothesis Testing

When sample sizes are small, exact or specialized methods like the binomial test are used instead of normal approximations. This ensures accurate p-values and conclusions, especially when testing if observed success rates (e.g., 28 out of 31) significantly differ from chance.

Recommended video:

Performing Hypothesis Tests: Proportions

5:52m

5:52mWatch next

Master Performing Hypothesis Tests: Proportions with a bite sized video explanation from Patrick

Start learningRelated Videos

Related Practice

Textbook Question

72

views