True or False: If the linear correlation coefficient is close to 0, then the two variables have no relation.

Table of contents

- 1. Intro to Stats and Collecting Data1h 14m

- 2. Describing Data with Tables and Graphs1h 55m

- 3. Describing Data Numerically2h 5m

- 4. Probability2h 16m

- 5. Binomial Distribution & Discrete Random Variables3h 6m

- 6. Normal Distribution and Continuous Random Variables2h 11m

- 7. Sampling Distributions & Confidence Intervals: Mean3h 23m

- Sampling Distribution of the Sample Mean and Central Limit Theorem19m

- Distribution of Sample Mean - Excel23m

- Introduction to Confidence Intervals15m

- Confidence Intervals for Population Mean1h 18m

- Determining the Minimum Sample Size Required12m

- Finding Probabilities and T Critical Values - Excel28m

- Confidence Intervals for Population Means - Excel25m

- 8. Sampling Distributions & Confidence Intervals: Proportion2h 10m

- 9. Hypothesis Testing for One Sample5h 8m

- Steps in Hypothesis Testing1h 6m

- Performing Hypothesis Tests: Means1h 4m

- Hypothesis Testing: Means - Excel42m

- Performing Hypothesis Tests: Proportions37m

- Hypothesis Testing: Proportions - Excel27m

- Performing Hypothesis Tests: Variance12m

- Critical Values and Rejection Regions28m

- Link Between Confidence Intervals and Hypothesis Testing12m

- Type I & Type II Errors16m

- 10. Hypothesis Testing for Two Samples5h 37m

- Two Proportions1h 13m

- Two Proportions Hypothesis Test - Excel28m

- Two Means - Unknown, Unequal Variance1h 3m

- Two Means - Unknown Variances Hypothesis Test - Excel12m

- Two Means - Unknown, Equal Variance15m

- Two Means - Unknown, Equal Variances Hypothesis Test - Excel9m

- Two Means - Known Variance12m

- Two Means - Sigma Known Hypothesis Test - Excel21m

- Two Means - Matched Pairs (Dependent Samples)42m

- Matched Pairs Hypothesis Test - Excel12m

- Two Variances and F Distribution29m

- Two Variances - Graphing Calculator16m

- 11. Correlation1h 24m

- 12. Regression3h 33m

- Linear Regression & Least Squares Method26m

- Residuals12m

- Coefficient of Determination12m

- Regression Line Equation and Coefficient of Determination - Excel8m

- Finding Residuals and Creating Residual Plots - Excel11m

- Inferences for Slope31m

- Enabling Data Analysis Toolpak1m

- Regression Readout of the Data Analysis Toolpak - Excel21m

- Prediction Intervals13m

- Prediction Intervals - Excel19m

- Multiple Regression - Excel29m

- Quadratic Regression15m

- Quadratic Regression - Excel10m

- 13. Chi-Square Tests & Goodness of Fit2h 21m

- 14. ANOVA2h 28m

1. Intro to Stats and Collecting Data

Intro to Stats

Problem 4.1.34a

Textbook Question

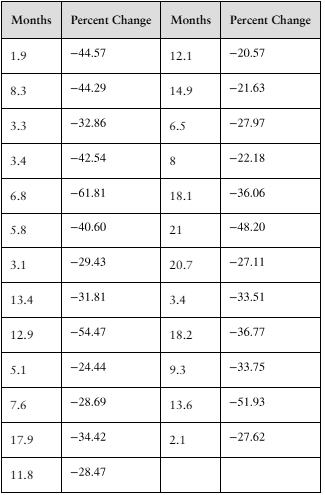

[DATA] Bear Markets A bear market in the stock market is defined as a condition in which the market declines by 20% or more over the course of at least two months. The following data represent the number of months and percentage change in the S&P 500 (a group of 500 stocks) for a sample of bear markets.

a. Treating the length of the bear market as the explanatory variable, draw a scatter diagram of the data.

Verified step by step guidance

Verified step by step guidance1

Step 1: Identify the variables for the scatter diagram. The explanatory variable (independent variable) is the length of the bear market in months, and the response variable (dependent variable) is the percent change in the S&P 500 index.

Step 2: Label the horizontal axis (x-axis) as 'Months' and the vertical axis (y-axis) as 'Percent Change'. This setup reflects that the percent change depends on the length of the bear market.

Step 3: Plot each pair of data points from the table on the graph. For each row, find the value of 'Months' on the x-axis and the corresponding 'Percent Change' on the y-axis, then mark a point at that coordinate.

Step 4: After plotting all points, observe the overall pattern or trend in the scatter diagram. This can help in understanding the relationship between the length of the bear market and the percent change.

Step 5: Optionally, add a title to the scatter diagram such as 'Scatter Diagram of Bear Market Length vs. Percent Change' to clearly indicate what the graph represents.

Verified video answer for a similar problem:

Verified video answer for a similar problem:This video solution was recommended by our tutors as helpful for the problem above

Video duration:

1mPlay a video:

0 Comments

Key Concepts

Here are the essential concepts you must grasp in order to answer the question correctly.

Scatter Diagram

A scatter diagram is a graphical representation that displays the relationship between two quantitative variables. Each point on the plot corresponds to one observation with coordinates representing the values of the two variables. It helps visualize patterns, trends, or correlations between variables, such as the length of bear markets and their percent changes.

Recommended video:

Probability of Mutually Exclusive Events

Explanatory and Response Variables

In statistical analysis, the explanatory variable (independent variable) is the one that is presumed to influence or predict changes in another variable, called the response variable (dependent variable). Here, the length of the bear market (months) is the explanatory variable, and the percent change in the S&P 500 is the response variable.

Recommended video:

Guided course

Intro to Random Variables & Probability Distributions

Correlation and Association

Correlation measures the strength and direction of a linear relationship between two variables. Understanding whether longer bear markets are associated with larger percent declines involves assessing correlation. A scatter plot helps identify if a positive, negative, or no correlation exists between months and percent change.

Recommended video:

Guided course

Correlation Coefficient

2:13m

2:13mWatch next

Master Introduction to Statistics Channel with a bite sized video explanation from Patrick

Start learningRelated Videos

Related Practice

Textbook Question

45

views