Understanding market behavior involves analyzing how consumers value goods, which is captured by the concept of willingness to pay. This term refers to the maximum amount a consumer is prepared to spend for a product, reflecting the benefit or utility they expect to receive. For instance, if a consumer believes a hamburger provides \$5 worth of satisfaction, they will not pay more than \$5 for it. This idea forms the foundation for calculating consumer surplus, a key measure in economics that quantifies the extra benefit consumers gain when they pay less than their maximum willingness to pay.

Consumer surplus is calculated as the difference between the willingness to pay and the actual market price. Mathematically, it is expressed as:

\[\text{Consumer Surplus} = \text{Willingness to Pay} - \text{Price}\]

For example, if the market price of a hamburger is \$3 and a consumer values it at \$5, the consumer surplus is \$5 - \$3 = \$2. This surplus represents the additional value or "free benefit" the consumer enjoys beyond the price paid. Although it might seem like a simple calculation, consumer surplus effectively captures the economic advantage consumers receive in a transaction.

It is important to note that consumer surplus cannot be negative. Rational consumers will not purchase a product if the price exceeds their willingness to pay, as this would make them worse off. For example, if a consumer’s willingness to pay is \$4 but the price is \$5, they will choose not to buy the product, resulting in zero consumer surplus.

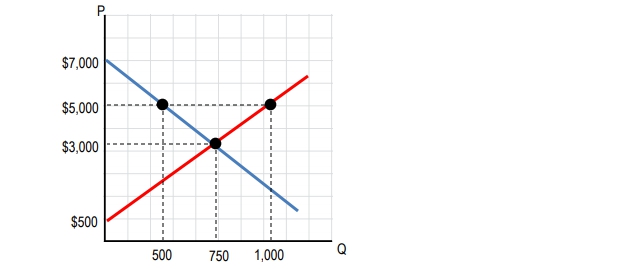

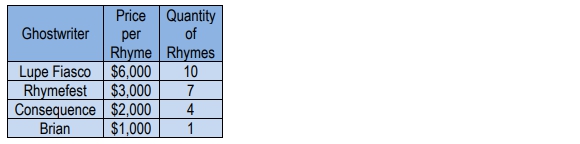

When prices decrease, consumer surplus increases because more consumers find the product worth purchasing. If the price drops to \$1, a consumer willing to pay \$6 gains a surplus of \$5, while another willing to pay \$4 gains \$3, and so on. This dynamic illustrates how price changes affect consumer behavior and overall market welfare.

By expressing preferences and benefits in monetary terms, willingness to pay and consumer surplus provide powerful tools for analyzing market outcomes. These concepts help economists evaluate how changes in prices influence consumer satisfaction and market efficiency, laying the groundwork for deeper exploration of supply and demand interactions.