To understand the demand curve for public goods, it's essential to first grasp how we derive the demand curve for private goods. The demand curve for a private good is created by aggregating the individual quantities demanded at each price point. For instance, consider cheeseburgers as a private good, which is both rivalrous and excludable. If we have two individuals in a society, we can illustrate their demand at various prices. At a price of \$5, both individuals may demand one cheeseburger each, resulting in a total market demand of two cheeseburgers. If the price drops to \$3, the first individual might demand five cheeseburgers while the second demands three, leading to a total market demand of eight cheeseburgers at that price.

This process of summing individual demands is referred to as horizontal addition, where we combine the quantities demanded by each individual at each price level to form the market demand curve. This method can be extended to larger populations, maintaining the same principle of aggregation.

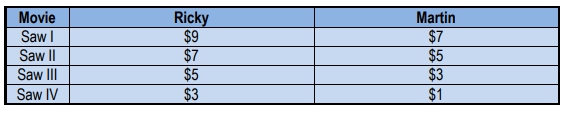

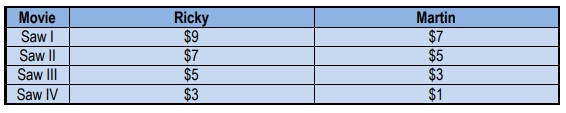

Transitioning to public goods, the demand curve operates differently. Public goods are characterized by being non-rivalrous and non-excludable, meaning that one person's consumption does not diminish another's ability to consume the good, and individuals cannot be effectively excluded from using it. To determine the optimal quantity of a public good, we must consider the collective willingness to pay rather than individual demands. This involves vertically summing the individual demand curves, as each person's valuation of the public good contributes to the overall demand. The intersection of the total willingness to pay and the cost of providing the public good helps identify the optimal quantity that maximizes social welfare.

In summary, while private goods require horizontal summation of individual demands to establish market demand, public goods necessitate vertical summation to reflect the collective value placed on the good by society. Understanding these distinctions is crucial for analyzing how public goods are allocated and funded in an economy.