Table of contents

- 1. Introduction to Macroeconomics2h 3m

- 2. Introductory Economic Models1h 7m

- 3. Supply and Demand3h 20m

- Introduction to Supply and Demand4m

- The Basics of Demand6m

- Individual Demand and Market Demand3m

- Shifting Demand38m

- The Basics of Supply2m

- Individual Supply and Market Supply6m

- Shifting Supply25m

- Overview of Supply and Demand Shifts8m

- Supply and Demand Together: Equilibrium, Shortage, and Surplus8m

- Supply and Demand Together: One-sided Shifts20m

- Supply and Demand Together: Both Shift34m

- Supply and Demand: Quantitative Analysis40m

- 4. Elasticity2h 25m

- Percentage Change and Price Elasticity of Demand18m

- Elasticity and the Midpoint Method20m

- Price Elasticity of Demand on a Graph11m

- Determinants of Price Elasticity of Demand6m

- Total Revenue Test13m

- Total Revenue Along a Linear Demand Curve14m

- Income Elasticity of Demand23m

- Cross-Price Elasticity of Demand11m

- Price Elasticity of Supply12m

- Price Elasticity of Supply on a Graph3m

- Elasticity Summary9m

- 5. Consumer and Producer Surplus; Price Ceilings and Price Floors3h 11m

- WIllingness to Pay and Consumer Surplus20m

- Willingness to Sell and Producer Surplus10m

- Economic Surplus and Efficiency18m

- Quantitative Analysis of Consumer and Producer Surplus at Equilibrium28m

- Price Ceilings, Price Floors, and Black Markets38m

- Quantitative Analysis of Price Ceilings and Floors: Finding Points20m

- Quantitative Analysis of Price Ceilings and Floors: Finding Areas54m

- 6. Introduction to Taxes1h 29m

- 7. Externalities54m

- 8. The Types of Goods1h 3m

- 9. International Trade1h 16m

- 10. Measuring National Output and Income 54m

- 11. Unemployment and Inflation1h 34m

- Labor Force and Unemployment10m

- Types of Unemployment12m

- Unemployment: Minimum Wage Laws and Efficiency Wages7m

- Inflation and Consumer Price Index (CPI)16m

- Using CPI to Adjust for Inflation7m

- Problems with the Consumer Price Index (CPI)5m

- Nominal Income and Real Income12m

- Nominal Interest, Real Interest, and the Fisher Equation5m

- Who is Affected by Inflation?5m

- Demand-Pull and Cost-Push Inflation6m

- Costs of Inflation: Shoe-leather Costs and Menu Costs4m

- 12. Productivity and Economic Growth1h 3m

- 13. The Financial System1h 30m

- 14. Income and Consumption52m

- 15. Deriving the Aggregate Expenditures Model1h 14m

- 16. Aggregate Demand and Aggregate Supply Analysis1h 22m

- Aggregate Demand17m

- Deriving Aggregate Demand from the Aggregate Expenditure Model12m

- Shifting Aggregate Demand4m

- Long Run Aggregate Supply9m

- Short Run Aggregate Supply7m

- Shifting Short Run Aggregate Supply8m

- AD-AS Model: Equilibrium in the Short Run and Long Run5m

- AD-AS Model: Shifts in Aggregate Demand18m

- 17. The Monetary System58m

- The Functions of Money; The Kinds of Money8m

- Defining the Money Supply: M1 and M22m

- Required Reserves and the Deposit Multiplier8m

- Introduction to the Federal Reserve8m

- The Federal Reserve and the Money Supply11m

- History of the US Banking System9m

- The Financial Crisis of 2007-2009 (The Great Recession)10m

- 18. Monetary Policy1h 26m

- 19. Fiscal Policy52m

- 20. Tradeoffs Between Inflation and Unemployment1h 2m

- 21. Open-Economy Macroeconomics1h 44m

- Balance of Payments: Introduction5m

- Balance of Payments: Current Account8m

- Balance of Payments: Financial Account and Capital Account7m

- Net Exports Equal Net Foreign Investment7m

- Balance of Trade; Trade Deficit and Trade Surplus6m

- Exchange Rates: Introduction14m

- Exchange Rates: Nominal and Real13m

- Exchange Rates: Equilibrium8m

- Exchange Rates: Shifts in Supply and Demand11m

- Exchange Rates and Net Exports6m

- Exchange Rates: Purchasing Power Parity3m

- The Gold Standard4m

- The Bretton Woods System6m

- 22. Macroeconomic Schools of Thought40m

- 23. Dynamic AD/AS Model32m

11. Unemployment and Inflation

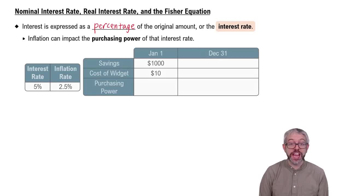

Nominal Interest, Real Interest, and the Fisher Equation

Struggling with Macroeconomics?

Join thousands of students who trust us to help them ace their exams!Watch the first video

Nominal Interest, Real Interest, and the Fisher Equation

Brian Krogol

Video duration:

10mPlay a video:

Related Videos

Related Practice